Key Takeaways

The Colorado SecureSavings Roth IRA program was signed into law in July 2020

All private-sector businesses with 5+ employees in operation for 2+ years must offer a qualified retirement plan like a 401(k)—or face fines

The first deadline required employers with 50+ employees to comply by March 15, 2023—while employers with 15-49 employees must comply by May 15, 2023.

Nearly a million Colorado employees who don’t currently have access to a retirement plan at work could soon have an easier way to start saving. Colorado has joined the ranks of states that require businesses to provide qualified retirement savings plans or enroll their eligible workers in a state-sponsored Roth Individual Retirement Account (IRA) plan.

Colorado SecureSavings will require all private-sector employers with at least five employees that have been in business for at least two years to facilitate the program if they don’t offer a retirement plan. While the program offers a Roth IRA to employees, employers can choose a qualified retirement plan like a 401(k) to meet state requirements instead.

Deadlines are staggered out in 2023, starting with employers with more than 50 employees on March 14, and ending with employers with between five and 14 employees on June 30.

Here’s what employers need to know about the Colorado Secure Savings Program.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Colorado Secure Savings Plan auto-IRA with a 401(k) plan.

Colorado SecureSavings deadlines & details

The Colorado Secure Savings Program (Senate Bill 20-200) was signed into law by Governor Jared Polis in July 2020. All eligible employers in Colorado are required by law to facilitate the program by the following dates if they don’t offer a retirement plan:

Employers with 50+ employees: March 15, 2023

Employers with 15-49 employees: May 15, 2023

Employers with 5-14 employees: June 30, 2023

The program will impact every private-sector business with five or more employees that have been in business for at least two years. If you offer a 401(k) or another qualified retirement plan, you’re exempt from having to offer the Colorado Secure Savings Program to eligible employees (certify your exemption here). Additionally, there are exemptions for employers who have sponsored the following during the last two years:

A qualified retirement plan under Internal Revenue Code Section 401(a), 401(k) or 403(a)

A 403(b) tax-sheltered annuity plan

A 457(b) deferred compensation plan

A simplified employee pension (SEP) plan

A savings incentive match plan for employees (SIMPLE 401(k) or IRA plan)

Penalties for businesses found in non-compliance

Employers found to be non-compliant will be fined up to $100 per eligible employee per year, not to exceed an aggregate amount of $5,000 in a calendar year. Enforcement of fines will not begin until at least one year after the program is established or one year after an employer is scheduled to enter the program, whichever is later.

What Colorado SecureSavings means for employers

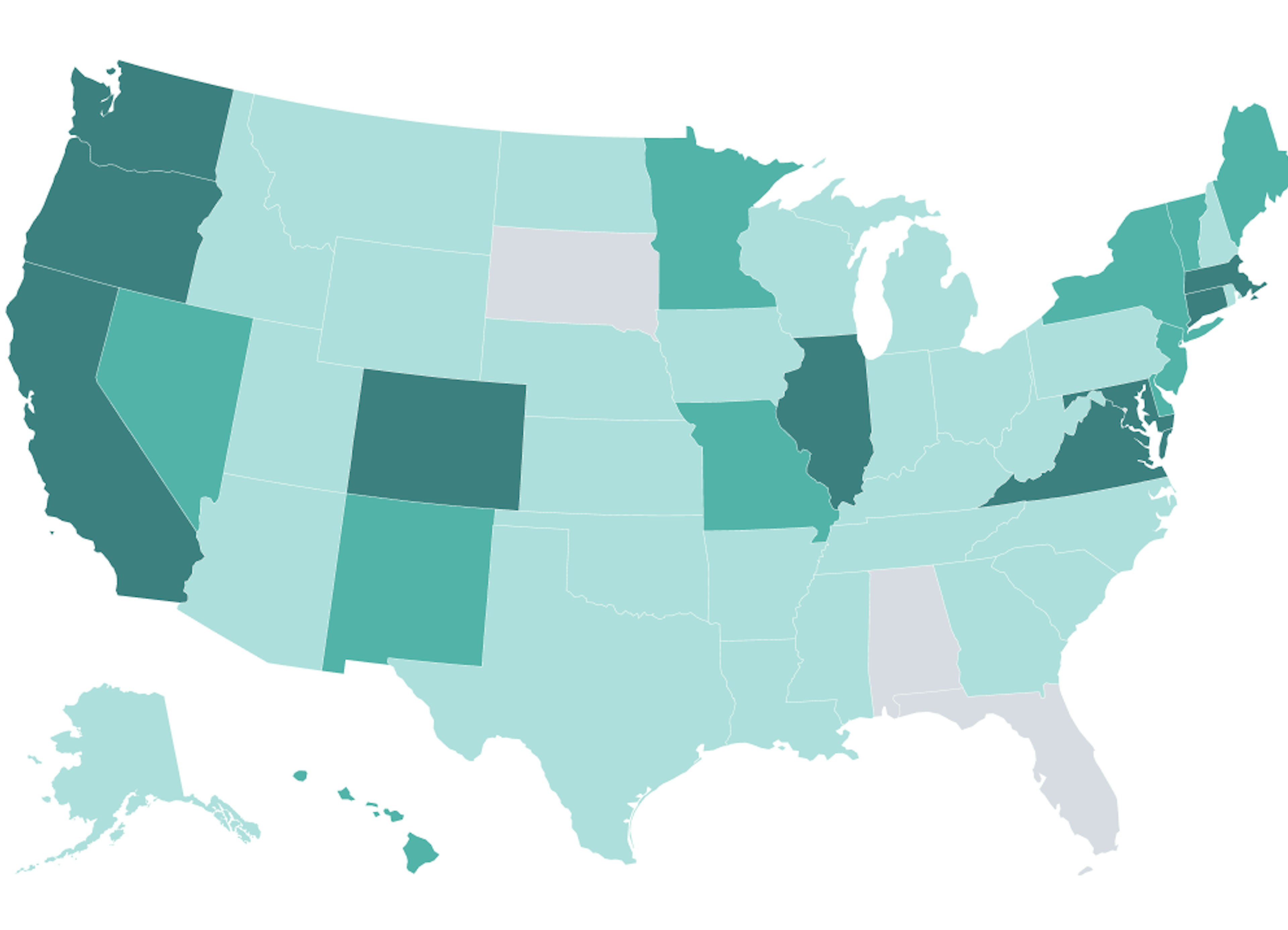

In 2021, the Colorado Treasurer announced its plan to offer the first-ever multi-state IRA program with New Mexico. The first-of-its-kind agreement between the Colorado SecureSavings program and the New Mexico Work and Save program could help preserve retirement savings for the thousands of people who move across the Colorado-New Mexico border every year.

Retirement portability can help prevent participants from cashing out critical retirement funds when faced with liquidating and transferring money between accounts. While cashout leakage usually impacts people changing jobs, it also becomes a factor for state-facilitated IRA participants who move states. The decision to partner together could reduce costs and increase portability for individuals who move between the two states.

Employer tax benefits for offering a retirement benefit

The state plans to establish grants to help defray costs and encourage small businesses—only those with five to 25 employees—to implement retirement savings plans. Grants will not exceed $300 for a single employer. In contrast, the tax benefits available to eligible employers for starting a 401(k) or other qualified retirement plan are higher. The SECURE Act 2.0 expanded tax credits to cover the following:

A tax credit for starting up a retirement plan: Businesses with up to 50 employees may be eligible for a tax credit to cover 100% of plan start-up costs (up from 50%), capped annually at $5,000 for three years (a total of $15,000). Eligible businesses with 51-100 employees may be eligible for a tax credit to cover 50% of plan start-up costs, capped annually at $5,000 for three years.

A tax credit for offering employer contributions: Businesses with up to 50 employees are eligible to receive a new tax credit based on a percentage of employer contributions, up to $1,000/employee for those making less than $100,000. Additionally, employers with 51-100 employees qualify for a phase-in credit (click here to learn more).

A tax credit for auto-enrolling employees: $1,500 total, or $500 per year for three years.

Use our calculator to see how much a 401(k) may cost with SECURE Act tax credits

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Colorado Secure Savings Plan auto-IRA with a 401(k) plan.

Employer administrative burden with every pay period

As written, employers will have 14 days to send employees’ contributions to the program administrator (the board of the Colorado Secure Savings Program). The board will be establishing a process for withholding contributions from employees’ wages and remitting withheld amounts into their Colorado Secure Savings account. It’s not yet clear if the program will offer any integrations with payroll providers to facilitate the timely deposit of contributions.

Retirement benefits for employees

Who is affected: Employees who are 18 years of age or older, have been employed by a Colorado employer for at least 180 days, and who earn taxable wages in Colorado will be enrolled in the state Roth IRA plan if their employer doesn’t offer a plan.

How much is taken from your paycheck: The employee’s state Roth IRA will be funded through an automatic payroll deduction, starting with a 5% Roth deferral rate.

Withdrawals: Employees will be allowed to withdraw their contributions from their account at any time without taxes or penalties, but earnings credited to their account may be subject to taxes and penalties unless certain criteria are met.

Investment options: The program has a private investment consultant that provides input and monitoring about investments. Colorado SecureSavings offers several target retirement date options. If participants take no action, contributions are automatically invested in a Capital Preservation Option (a U.S. Government Money Market Fund) until the first applicable sweep date (generally 30 days from a participant’s first Contribution). At that point, the Capital Preservation Option will be exchanged for units of equal value in the Target Retirement Date Option with a target date closest to a participant’s projected year of retirement (assuming a retirement age of 65).

Income restrictions: Like any other Roth IRA account, the amount that you can contribute depends on your age, income, and marital status. In 2026, participants can make the maximum contribution ($7,500 if you’re under age 50 or $8,600 if you’re age 50+), provided their Modified Adjusted Gross Income (MAGI) is under $168,000 for tax year 2026 and $165,000 for tax year 2025. If participants are married and file jointly, their MAGI must be under $252,000 for tax year 2026 and $246,000 for tax year 2025.

Increasing accessibility for Coloradans

The American Retirement Association (ARA) estimates that 91,808 employers in the state of Colorado do not provide a retirement plan to their employees. Colorado’s Senate Bill 20-200, estimates that means more than 900,000 workers, or about 40% of working Coloradans, are without an employer-sponsored retirement plan, with young and minority workers more likely to lack access. According to the Senate Bill:

Young and minority workers: Nearly 50% of workers between the age of 25 and 29; 46% of African-American workers; and 59% of Latinx workers in Colorado lack access to a workplace retirement program.

Lower-wage workers: Similarly, the state’s lowest-wage workers are also less likely to have access to such a savings program, including nearly 70% in the lowest-income quintile.

Small business employers: Just 19% of small employers are able to offer a retirement plan, despite many wanting to do so.

What Colorado small businesses can do to prepare

Now is the time for employers to start thinking about whether they want to offer their own program or whether the state-facilitated Roth IRA would best suit their needs. Most Colorado businesses that will be adding retirement planning options and services for workers should be ready to communicate with employees and launch their savings program sometime in 2023.

Consider what retirement plan makes sense for your needs. In addition to the state-provided Roth IRA, employers can choose from a number of other retirement plans to fulfill requirements, including a 401(k), 403(b), SEP-IRA, or SIMPLE IRA. Determine what makes sense for your workforce, based on the flexibility, features, and tax benefits.

Read about tax benefits of starting a 401(k): The SECURE Act 2.0 expanded on existing tax advantages. Read more about the tax advantages the SECURE Act 2.0 may offer small businesses.

Ensure your payroll system is ready. Once the state program is announced, you can check to see if your payroll system will integrate with the state plan. Alternatively, you can look at other retirement plan providers for payroll integrations. Human Interest integrates with 500+ leading payroll providers if you choose a Human Interest 401(k).

Remember that non-compliance can be costly. Failure to comply with program requirements can result in a fine of up to $100 per employee not to exceed $5,000 total in a year. While enforcement won’t go into effect until at least one year after the Secure Savings Program’s start date, you won’t want to find yourself in a bad situation.

Considering a retirement plan for your employees? We're here to help.

A 401(k) is an alternative to Colorado SecureSavings

Talk to an expert today.

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.