Safe harbor 401(k) plans for you & your team.

Start a safe harbor 401(k) to automatically pass important, annual IRS tests.1

Why should you add a safe harbor provision?

Less red tape for employers. More opportunity to save for employees.

Avoid administrative hassles: Safeguard your business from key nondiscrimination tests.

Empower employees to save: Employer matches can help boost participation rates.2

Avoid ADP and ACP testing: Safe harbor contributions help plans pass most annual tests.

Max out your savings: Safe harbor allows ALL participants to max out contributions without fear of refunds.

Why a safe harbor plan?

Focus on running your business. Not your 401(k).

All 401(k) plans must pass annual IRS tests to show they don't favor high-earning employees or owners.

Adding a safe harbor provision excuses your company from some key tests—while helping all employees maximize their contributions.

401(k) plans designed for you and your employees

Complete safe harbor solutions for small business owners

Benefit from tax credits: Employers may be eligible for tax credits of up to $5,000/year for three years for setting up a new 401(k) + $500/year for three years for setting up auto-enrollment.3

Reduce your manual work: Integration with 500+ payroll providers helps automate essential administrative tasks.4

Customize your plan: Flexible plan design means you can choose a safe harbor provision that meets your needs.

Safe harbor options to

meet your needs

Most affordable

Basic match option provides 100% match on the first 3% of employee contributions + 50% match on the next 2%.

Most popular

Enhanced match options must match 100% on the first 4-6% of employee contributions and are most popular at Human Interest.5

Most employees covered

Nonelective options must provide a 3% contribution or more for each employee—whether they contribute or not.6

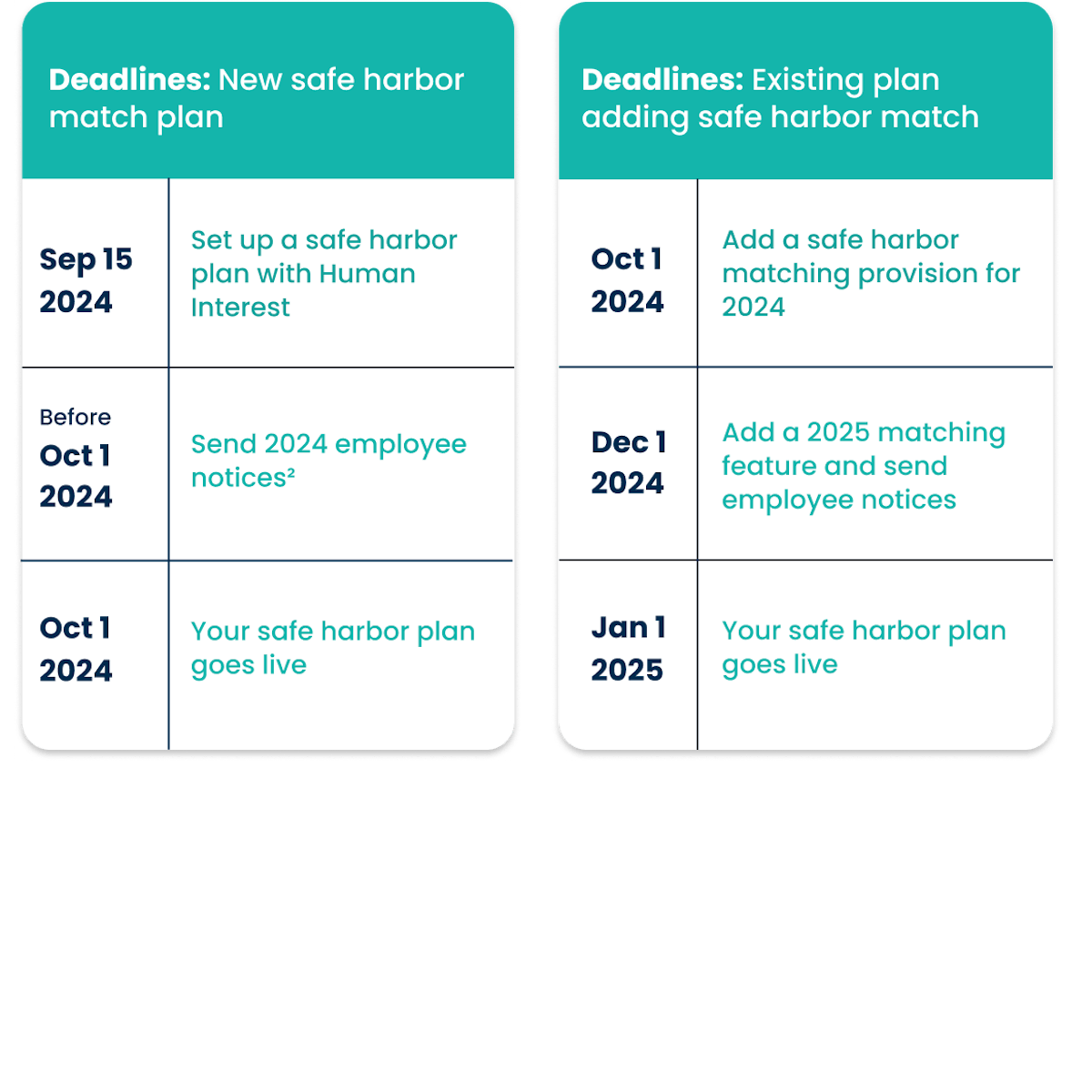

Safe harbor provision deadlines

Add a safe harbor plan today. Help your employees save for tomorrow.6

Get Started

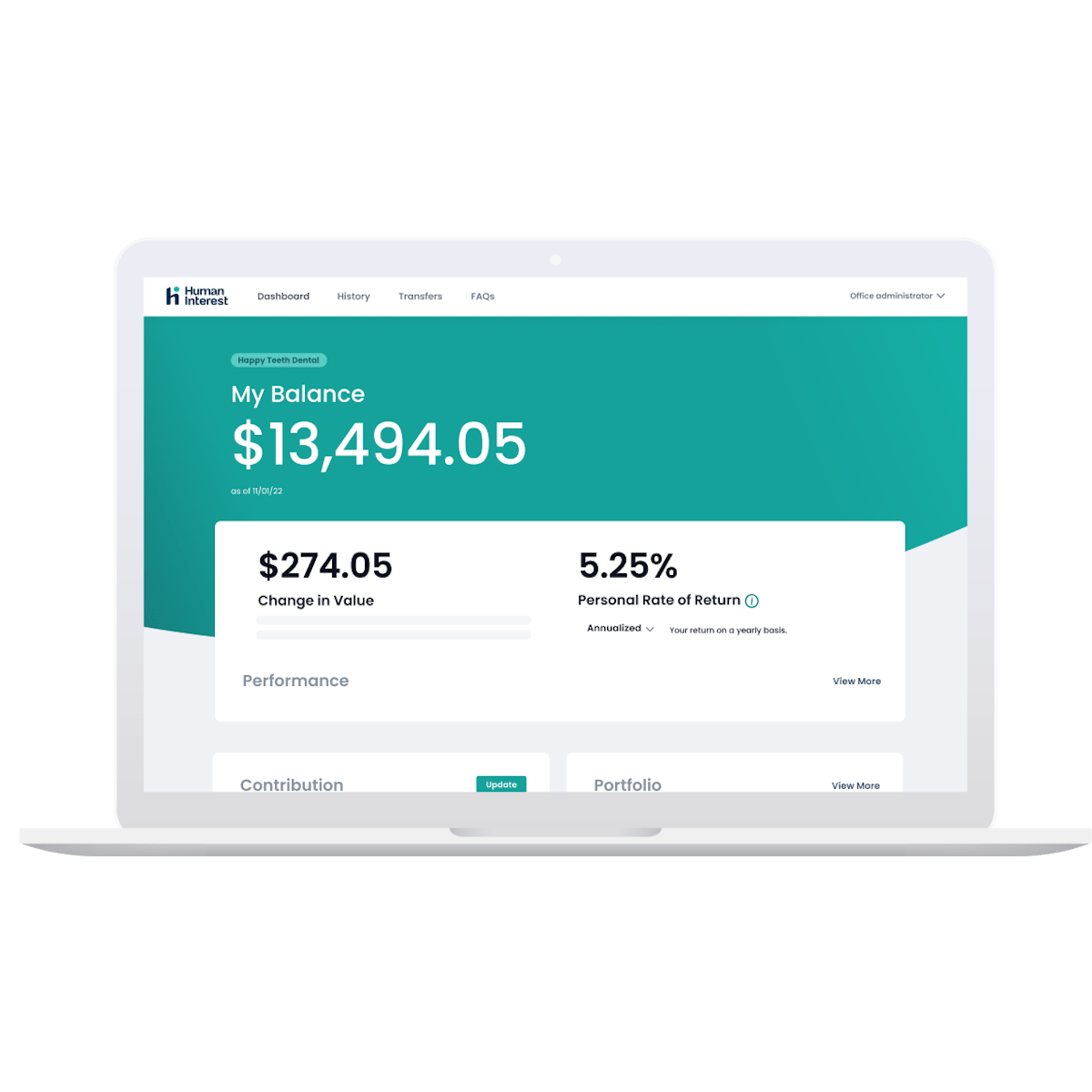

How much does it cost?

Human Interest plans come with transparent pricing and zero transaction fees.* Employers have an affordable monthly rate and pay safe harbor contributions to their employees.

Monthly pricing starting at only:

base fee

per eligible employee

An investment advisory fee is paid to Human Interest Advisors (HIA) of 0.01% of plan assets and a separate fee for recordkeeping services and custody-related expenses is paid to Human Interest Inc. (HII) of 0.05% of plan assets. Both fees are deducted on a monthly basis from the employee's account according to the HII and HIA Terms of Service. All prices are exclusive of applicable taxes. If the plan sponsor elects to hire an external investment advisor, the plan sponsor will pay such advisor as agreed between the plan sponsor and advisor. For more information, please see our pricing page.

* Applies to all transaction types. For non-rollover distributions, shipping and handling fees may apply to requests for check issuance and delivery.

Start your safe harbor 401(k) in a few easy steps

1

Provide your information

Enter basic details

2

Customize your plan

Choose from flexible designs

3

Launch your 401(k) plan

We'll connect & launch your plan

Safe harbor 401(k) frequently asked questions