For employers

Content designed to educate employers on starting and running your 401(k) plans and more.

Maximize tax savings and fuel business growth with your 401(k)

Understanding retirement balance rollovers

Human Interest 401(k) vs Maine Retirement Savings Program: how do they compare?

Human Interest vs Delaware EARNS: How do they compare?

Everything to Know About Safe Harbor 401(k) Plans

Human Interest 401(k) vs. New Jersey Secure Choice: how do they compare?

Human Interest 401(k) vs. Maryland Small Business Savings: how do they compare?

Human Interest vs. Colorado Secure Savings Plan: how do they compare?

Human Interest vs. Illinois Secure Choice: how do they compare?

Human Interest 401(k) vs. MyCTSavings: how do they compare?

Human Interest 401(k) vs. OregonSaves: how do they compare?

Human Interest vs RetirePath Virginia: how do they compare?

401(k) vs. SIMPLE IRA

Human Interest: 403(b) vs. Simple IRA Comparison

Helping employers manage their retirement benefits

Retirement benefits to support your workforce

Providing comprehensive retirement benefits is crucial for supporting your workforce and increasing job satisfaction and loyalty. Our resources cover how to design and implement effective retirement plans that meet the needs of your employees. Learn about 401(k) employer matches, profit-sharing plans, and extending benefits to interns and part-time employees to create a more inclusive and supportive work environment.

Optimizing 401(k) plan features

Optimizing the features of your 401(k) plan can enhance employee participation and overall plan effectiveness. Our resources offer strategies to maximize the benefits of safe harbor plans, breakdown the cost of a 401(k), and offer various plan design options and responsibilities - ensuring your retirement plans are robust and attractive.

Ensuring your plan remains in compliance

Staying compliant with regulatory requirements is essential to managing a successful retirement plan. Our resources help you navigate 401(k) compliance and administration, including nondiscrimination testing, IRS audit preparation, and understanding the roles of fiduciaries and third-party administrators to maintain compliant and well-managed plans.

Resources for informed decision-making

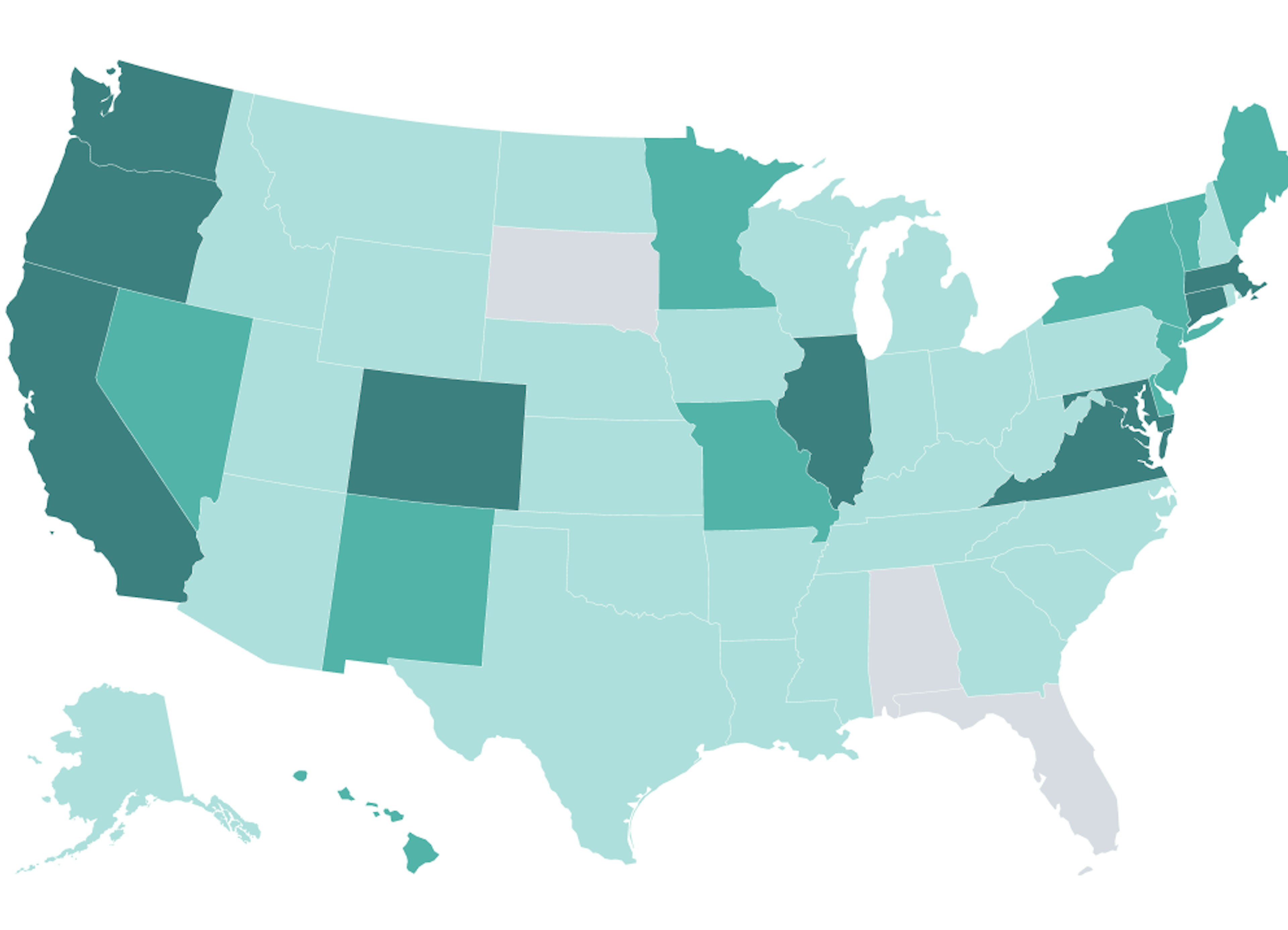

Use our calculators and guides to help make informed decisions about starting, converting, or managing a 401(k) or 403(b) plan. Use our webinars and guides to stay up-to-date on the latest news and industry trends across retirement legislation, state mandates, and more.