A 401(k) Alternative to Illinois' Secure Choice

See how a 401(k) compares to Secure Choice.

Is your company looking for an alternative to Illinois Secure Choice? A Human Interest 401(k) is an affordable option that meets state requirements.

Retirement plans are complex. Let Human Interest guide you.

Get guidance on 401(k) plan administration, IRS testing, and government filings for your Illinois business with expertise from Human Interest.

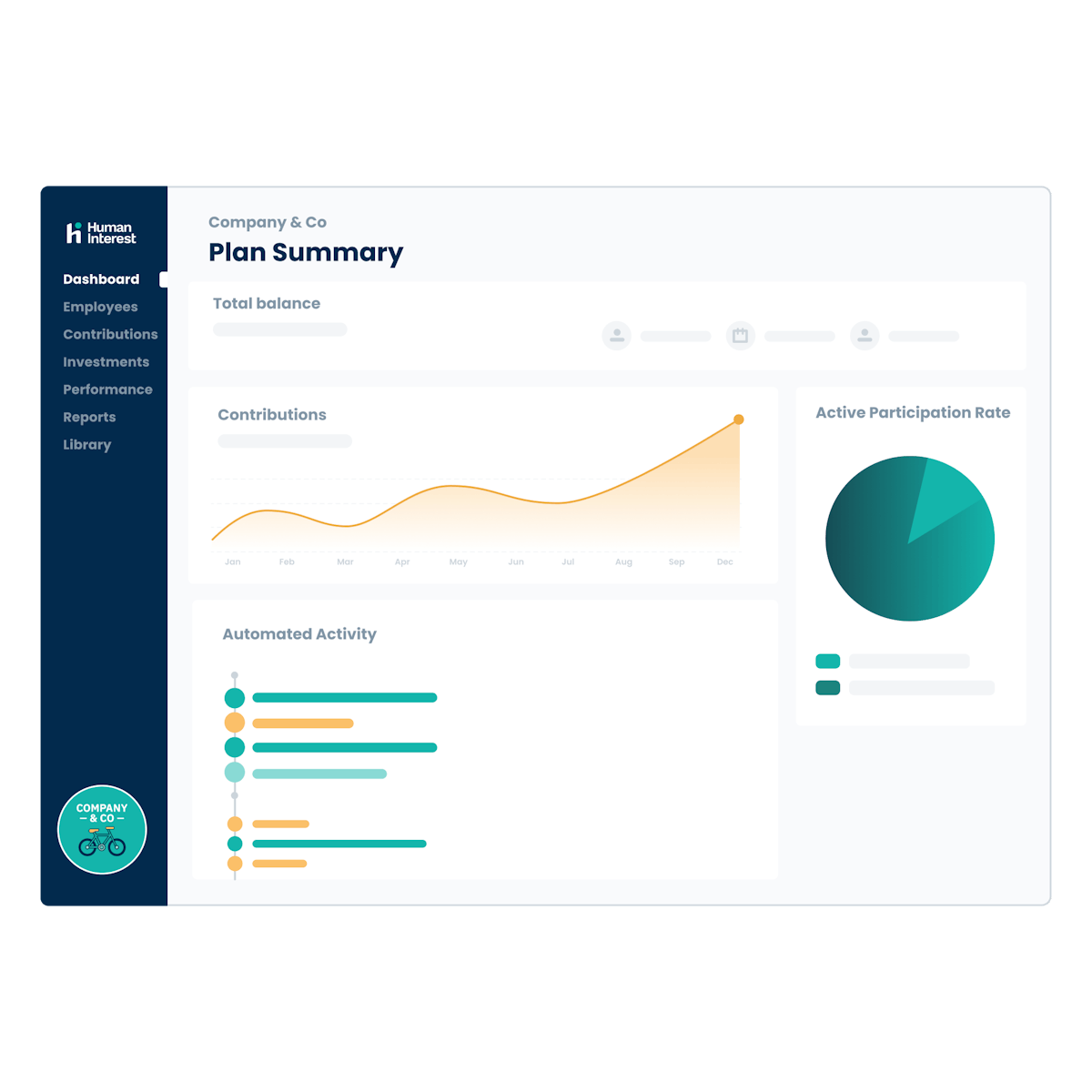

In-house recordkeeping

Automated plan administration tracks participation, contributions, distributions, and more.

Regulatory support

We provide support by preparing select government filings. And for some clients, we sign and file the Form 5500.1

On-demand reporting

Get a 360-degree view of your plan, access reports, and see which employees have joined.

Plan compliance & testing

Don’t stress about IRS testing and regulatory deadlines. We’ll help handle them for you.

Learn how a Human Interest 401(k) compares to Illinois Secure Choice

A 401(k) may be more affordable than you think.

Human Interest plans come with transparent pricing—and zero transaction fees*.

Monthly pricing starting at only:

base fee

per eligible employee

An investment advisory fee is paid to Human Interest Advisors (HIA) of 0.01% of plan assets and a separate fee for recordkeeping services and custody-related expenses is paid to Human Interest Inc. (HII) of 0.05% of plan assets. Both fees are deducted on a monthly basis from the employee's account according to the HII and HIA Terms of Service. All prices are exclusive of applicable taxes. If the plan sponsor elects to hire an external investment advisor, the plan sponsor will pay such advisor as agreed between the plan sponsor and advisor. For more information, please see our pricing page. * Applies to all transaction types. For non-rollover distributions, shipping and handling fees may apply to requests for check issuance and delivery.

An Illinois Secure Choice Alternative

Focus on running your business. We’ll help with your retirement plan.

Reduce manual work in processing contributions. Integration with 500+ payroll providers streamlines essential tasks.3

Easy to start, easy to use. Admin dashboards provide insight into plan participation, reporting, and more.

Automate administration. We offer recordkeeping and compliance—plus select fiduciary services depending on your plan.

The SMB 401(k) with the most payroll integrations3

Help take the burden off your HR team. We sync with 500+ payrolls to help streamline administrative tasks.

Illinois small business owners - start your 401(k) in minutes

1

Provide your information

Enter your basics (payroll provider, bank details, etc.)

2

Customize your plan

Choose from flexible plan designs to fit your needs

3

Launch your 401(k)

We’ll connect to your payroll provider and launch your plan