Key Takeaways

HB 152 seeks to establish a state-sponsored automatic-enroll IRA program for private-sector businesses in Mississippi

While exact dates are yet to be determined, if passed, employee enrollment is expected to begin in 2024

Unlike most other state-sponsored auto-IRA plans, participation is expected to be voluntary for businesses with fewer than 25 employees

Mississippi is considered the most affordable state in the United States to retire, as its economy is dominated by the public sector, which is known for its often generous retirement benefits. But the balance is starting to shift.

While government jobs in Mississippi have steadily declined over the last decade, the state is actively trying to attract tech startups. This means that the Magnolia State may soon also have to grapple with the fact that 32% of private-industry workers in the United States lack access to retirement programs through their employer.

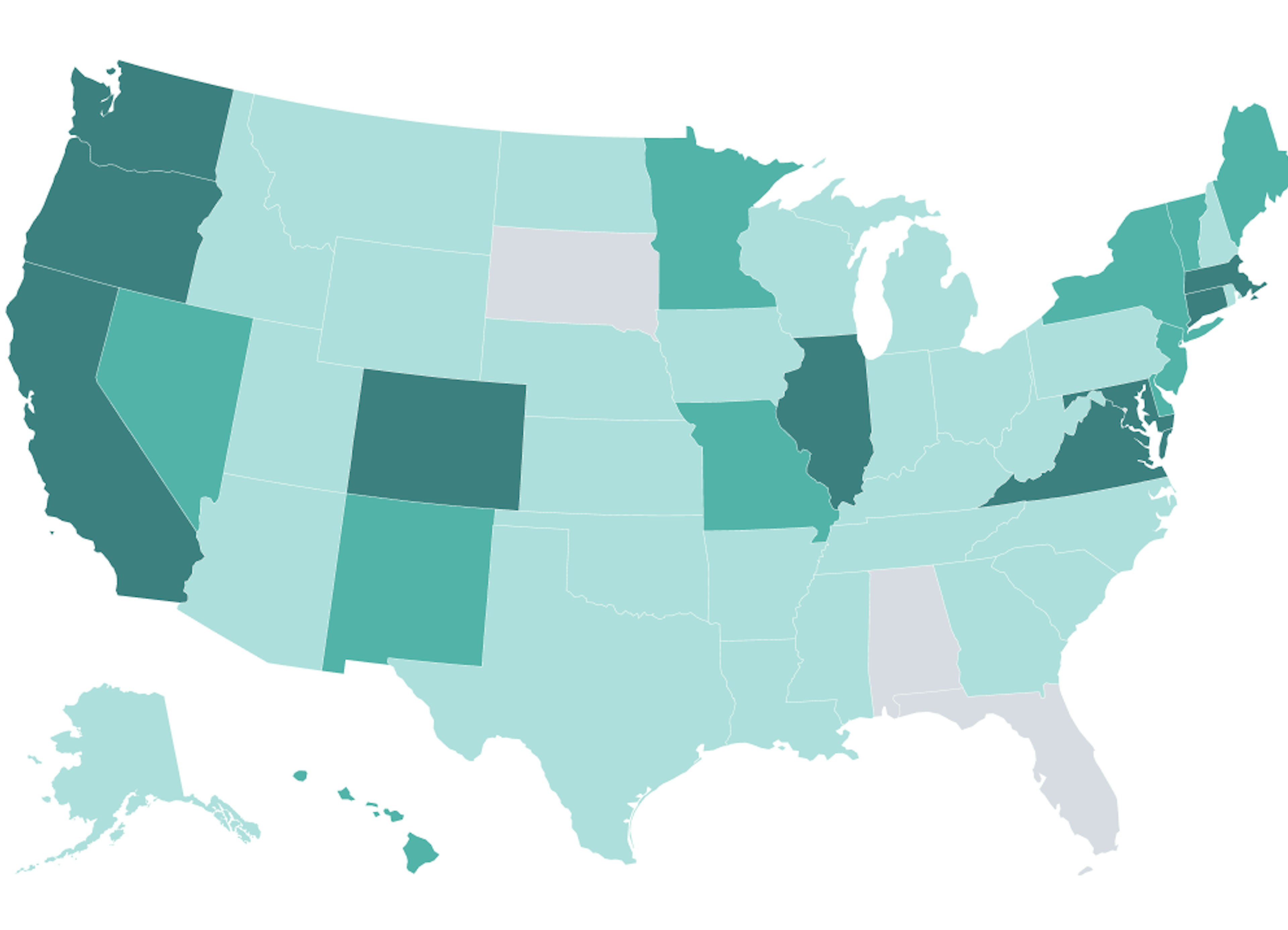

To address the retirement savings gap, Mississippi, along with Missouri and Rhode Island, is one of three states introducing a bill in 2022 to establish a state-sponsored retirement program. HB 152 seeks to establish the Mississippi Secure Choice Savings Program, joining 46 states that have passed or are considering similar legislation.

Does your Mississippi business qualify for 401(k) tax credits?

Learn if starting a plan comes with tax incentives.

Basics of the Mississippi Secure Choice Savings Program

Introduced on January 4, 2022, HB 152 seeks to establish an automatic enrollment payroll deduction IRA for employees of small businesses that don’t already offer a retirement savings program. While we don’t have final details surrounding HB 152, current legislation is intended to provide retirement savings for private-sector employees in a "convenient, low-cost, and portable manner."

The legislation outlines the process for creating a Mississippi Secure Choice Savings board. The board will be responsible for hiring investment managers, establishing investment options, designing employer and employee information packets, and determining the implementation schedule.

The board will determine the exact timeline, but if passed, employee enrollment is expected to begin in 2024 and employers will be required to enroll all eligible employees by December 31, 2026, after which they would face penalties.

We’ll keep an eye on the bill, which has been referred to the House Appropriations Committee.

How the Mississippi Secure Choice Savings Program works

According to the current version of HB 152, businesses that have been in operation for at least two years with 25 or more employees, and don’t have a qualifying retirement program, will be required to participate. According to the bill, qualified retirement plans include, but are not limited to, 401(a), 401(k), 403(a), 403(b), 408(k), 408(p) or 457(b) plans. Small businesses with fewer than 25 employees may participate on a voluntary basis.

Although employees will be automatically enrolled, they can opt out at any time. The default contribution will be between 3% and 6% (to be determined by the board), but employees are not locked into the default rate and can adjust their contribution percentage.

Aside from enrolling employees, employers’ responsibilities will include holding annual open enrollment and setting up a payroll deposit system to forward contributions to the program. Employers will have no liability related to workers’ decisions to opt in or out, the investment options provided by the board, or participants’ investment decisions. They can also choose to establish an employer retirement plan at any time.

Subject employers who fail to enroll employees will face a $250 penalty per employee for any portion of the first calendar year they are not enrolled. After the initial penalty period, employers will be assessed a $500 fine for any portion of a calendar year in which the employee is still not enrolled.

Learn more about Mississippi Secure Choice Savings Program alternatives:

Use our calculator to see how much a 401(k) would cost with SECURE Act tax credits applied.

Read more about the fees associated with launching and maintaining a 401(k) plan for your business.

Potential impacts of the Mississippi Secure Choice Savings Program

Mississippi’s newly proposed program is somewhat unique in that participation is voluntary for businesses with fewer than 25 employees. It has been common for states proposing such programs to exempt only the smallest businesses. Of the three states that have active state-sponsored auto-IRA retirement programs, California and Illinois require all employers with five or more employees who don’t have a qualified plan to participate, and Oregon requires all such employers of any size to participate.

Retirement data for the state is scant. However, as of 2010, AARP estimated 690,100 Mississippians lack access to a retirement program at work. According to the U.S. Small Business Administration (SBA) Office of Advocacy, 99.3% of Mississippi’s private-sector businesses are small businesses. Although the SBA’s definition of a “small business” varies, the agency reports that firms with fewer than 20 employees have the largest share of small business employment in Mississippi.

While the state is making efforts to grow its private-sector, these businesses are still in the minority. With most of these being small businesses that employ 20 or fewer workers, a retirement program that mandates participation for only businesses with larger employee populations seems largely forward-looking. Hopefully, smaller businesses will find the program attractive, but it remains to be seen how many will voluntarily sign on.

Is a 401(k) right for you?

Pending passage of HB 152, the Mississippi Secure Choice Savings Program is still two to four years out, and if it passes as is, the law may bypass private-sector small business workers who need it most.

If you run or help manage a business subject to HB 152, you have options to comply with upcoming legislation, including a 401(k) plan. If you run a smaller business, a 401(k) may offer advantages over a state-provided IRA program. And if you’re a startup founder trying to attract talent to an under-the-radar tech hub, providing an employer retirement plan sooner than 2024 may bolster your recruitment efforts.

No matter where your business fits into the evolving Mississippi economy, it’s important to compare all of the retirement plan options available to you.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.