Nonprofits have a huge economic impact on Massachusetts. In the Commonwealth, nonprofit businesses generate about $119 million in revenue and hold nearly $335 billion in assets. And the more than 33,000 nonprofits in Massachusetts employ nearly 17% of the workforce (more than half a million people). To help workers of these companies benefit from an employer-sponsored retirement plan, Massachusetts Defined Contribution CORE Plan launched in October 2017 as the country’s first state-sponsored multiple employer plan (MEP).

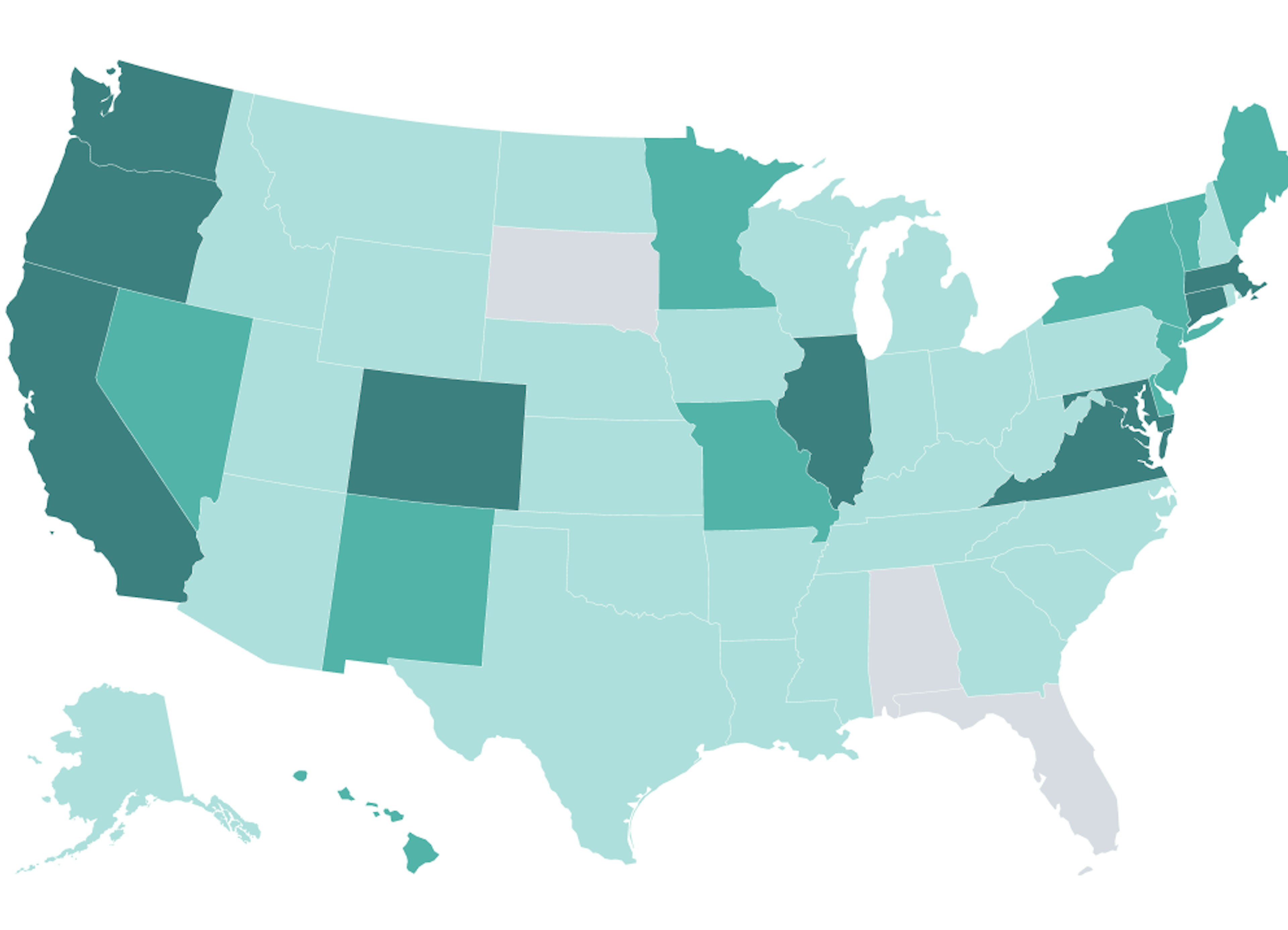

Compared to other state-sponsored retirement plans—including California, Illinois, and Oregon—that provide private-sector employers a way to set up individual retirement accounts (IRAs), Massachusetts offers a state-facilitated 401(k) MEP. And unlike many other mandatory state plans, the CORE Plan is optional, meaning that nonprofits with 20 or fewer employees can choose if they want to offer a 401(k) savings plan.

Does your Massachusetts business qualify for 401(k) tax credits?

Learn if starting a plan comes with tax incentives.

Basics of the Massachusetts Defined Contribution CORE plan

The Massachusetts Defined Contribution CORE Plan functions as a 401(k) retirement plan. This means that any amount that employees deposit into the plan is tax-deferred until retirement under a traditional plan. If a post-tax or Roth option is chosen, upon retirement, employees can withdraw funds tax-free provided they were contributed more than five years prior and they’re at least 59 1/2 years old.

While there are many financial companies out there serving as 401(k) administrators, the Commonwealth is undertaking the administration and fiduciary burden of the plan. For the employer, MEPs can be less expensive than engaging with a traditional 401(k) provider. As multiple, small, nonprofit employers join, the plan could ultimately scale as economically as a larger fund. For this reason, the CORE Plan had the support of the Massachusetts Nonprofit Network (MNN), which is billed as the “voice of the nonprofit sector” in Massachusetts.

“At small employers, access to quality retirement plans is often limited due to a lack of resources,” said State Treasurer Deb Goldberg. “The CORE Plan helps to close the retirement coverage gap within this critically important sector of the Massachusetts economy, and provides retirees and their families financial stability and security after leaving the workforce.” It has seemed to have worked so far. As of June 30, 2021:

More than 110 Massachusetts-based nonprofits have committed to joining

More than 700 eligible employees are covered

Of the eligible employees, 550 are active participants.

Total assets under management now exceed $11.7 million.

The CORE Plan also provides an option for a safe harbor matching contribution, which helps encourage employees with lower compensation to take advantage of the plan. A safe harbor matching contribution has the benefit of being immediately vested. With the current cap on employee contributions of 90% of their gross income (for federal income tax purposes)—or $23,500 in 2025 ($23,000 in 2024)—a safe harbor matching contribution works as follows:

| If employee contributes... (percent of compensation) | Then the employer must contribute (percent of compensation) |

|---|---|

| 1% | 1% |

| 2% | 2% |

| 3% | 3% |

| 4% | 3.5% |

| 5% | 4% |

| >5% | 4% |

Opting in and opting out

The CORE Plan is not mandatory. For employees to receive the benefits of the CORE Plan, employers must first choose to offer the plan. This leaves workers whose employer does not see the benefits of the Plan, or whose margins are too narrow to afford it—or for any other reason—without a retirement plan.

If the employer does sign-on, all employees are immediately included with 6% of their pay automatically deferred on a pre-tax basis into the CORE Plan in 60 days. Employees who wish to contribute more—or less—need to inform their plan representative. Employees who do not wish to be part of the plan will have to take the extra step of opting out.

Learn more about Massachusetts Define Contribution CORE Plan alternatives:

Use our calculator to see how much a 401(k) would cost with SECURE Act tax credits applied.

Read more about the fees associated with launching and maintaining a 401(k) plan for your business.

Pros & cons of multiple employer plans (MEPs)

In addition to several states that have passed legislation that mandates qualified businesses to offer retirement plans, the Federal government is increasingly encouraging small businesses to offer retirement benefits. The SECURE Act, which went into effect January 1, 2020, allows small employers to participate in MEPs.

MEPs offer several advantages because they pool resources among numerous participants. A MEP can be run by one organizer for several employers, creating a structure that can help alleviate some administrative burdens for employers and potentially reduce costs. Many of the responsibilities associated with managing a retirement plan are taken on by the MEP organizer, including responsibility for managing the plan, selecting and monitoring service providers, and day-to-day administration and compliance. Some additional benefits of a MEP can include better pricing on investments and reduced plan expenses.

Some nonprofits may prefer 401(k) or 403(b) plans because they can offer more flexibility to an individual employer, as opposed to being locked into the features chosen by an external organizer for a MEP. In this context, 401(k) and 403(b) plans can provide more control over service providers, plan design, and the participant experience. It also remains to be seen if the reduced cost of MEPs is competitive with some of the innovative, low-cost 401(k) products on the market now.

Providing a retirement plan to nonprofit employees in any form can be a generous benefit. However, 401(k) and 403(b) plans have become increasingly available to smaller nonprofits. If you’re interested in learning more about starting a flexible, affordable 401(k) for your nonprofit, contact Human Interest today.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.