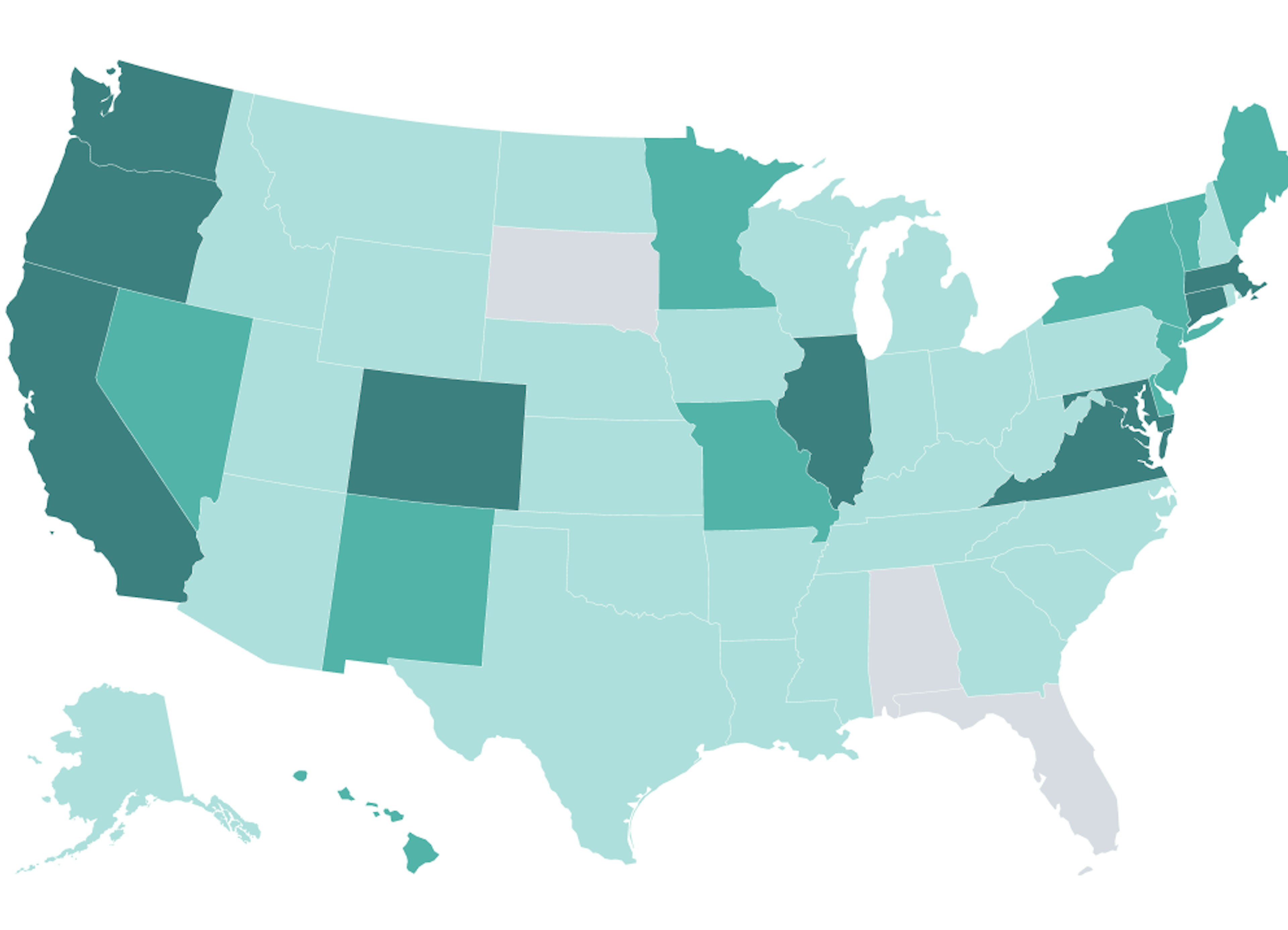

Privately-owned businesses in North Carolina may soon be required by law to offer retirement plans to their employees. As of mid-2022, 16 states (and two cities) have enacted retirement programs for private sector workers—and the Tarheel State may join those ranks.

These laws affect businesses of all sizes, from the mid-size to the mom and pop, and many require employers to offer a retirement plan or face fines. Most are Roth IRAs. And while companies may opt-in to the state-run programs, there are other alternatives that could help benefit their bottom line and their employees.

Let’s look at what’s going on in North Carolina that is giving rise to this legislation.

The state of the state

In 2020, North Carolina’s General Assembly met to study the causes and explore solutions to the state’s retirement savings problem. While 32% of private industry workers lack access to a retirement program, the percentage of North Carolinians in the same predicament is significantly higher. According to BLS data from 2020, it's 53% in North Carolina. What's more, the study suggests that even more part-time or independent contractors may not be covered by an employer-provided retirement plan.

Considering the state’s demographics, North Carolina's financial future could be considered tenuous. According to House Bill 899, “portable, low-cost, and consumer-protective” savings programs could help enhance North Carolinian’s retirement security and reduce pressures on state-provided public assistance programs for retirees.

What we know about the North Carolina Work and Save Bill

The North Carolina Work and Save Bill (House Bill 899) was introduced in May 2021. The bill calls on the North Carolina Small Business Retirement Savings Program Board to administer and manage the program on behalf of the program participants. Because it’s still under consideration, critical details are unknown.

As outlined in the bill, qualified employers include a person or business, whether for profit or not for profit (excluding government employers) that has not offered a qualified employer sponsored retirement plan—including a 401(k)—any time within the current or two preceding calendar years. There are a few specifics in the current version of the bill worth noting (many of which are in line with other state programs):

Employees will be automatically enrolled with a 5% Roth payroll deduction

Employees be able to opt out of the plan or choose to contribute to a Traditional (pre-tax) IRA in lieu of the Roth IRA option

Employers are not permitted to make contributions to these accounts

Employers must either facilitate a payroll deduction to this program or offer another option for retirement savings.

However, the legislation is still highly dynamic, and things could change before it’s signed into law. Even though the bill is still in the legislative shuffle, North Carolina business owners should make a note of July 2023 (and Human Interest will be sure to keep you updated).

Employers have a choice: 401(k) vs. state run IRA plans

Many details surrounding the North Carolina Work and Save Bill—including deadlines and penalties in other laws that have impacted states like California, Oregon, and Illinois—are still forthcoming. However, it’s worth noting that business owners have options. For example, North Carolina businesses can start a 401(k) plan today to avoid any upcoming deadlines.

In many cases, the 401(k) provides benefits for small and medium-sized businesses. One of which is that 401(k) plans allow employers to match employee contributions or provide a profit sharing contribution, which may be deductible on an employer’s federal income tax return. 401(k) plans also have higher employee contribution limits—$23,500 in 2025, with a catch-up contribution of $7,500 allowed for savers 50 years or older and an increased catch-up contribution of $11,250 allowed for savers aged 60-63—when compared to IRA plans.

For business owners who battle employee turnover, a 401(k) might help stop that revolving door. A Human Interest analysis of its customer base in Q1 2022 found that offering a retirement plan can boost retention—especially for small and medium-sized businesses. Not to mention, a 401(k) is an important recruiting tool in a labor market where the competition to hire top talent is stiff.

Time will dictate the outcome of the North Carolina Work and Save Bill. But Human Interest will be sure to keep our ears to the ground and keep our readers apprised of any developments. If you want to know how to get ahead of upcoming North Carolina retirement laws, contact us today to learn more about your options.

*Alison Hunter is an independent contractor commissioned by Human Interest to help contribute to this article.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.