Key Takeaways

Nearly 47 million people quit their jobs in 2021, with small and medium-sized businesses seeing the bulk of labor transfer

As the economy enters recovery mode, employees may be seeking better benefits and work flexibility

Human Interest found that offering a 401(k) plan may lead to lower turnover rates for small to medium-sized business

A few months into 2022 and the topic du jour of the business world still seems to be the Great Resignation. Coined in May 2021 by Dr. Anthony Klotz, associate professor of management at Texas A&M University, the term strives to summarize sentiments of an economy still reeling from the COVID-19 pandemic. As Klotz outlines, four major trends inspired its origination.

Backlog of resignations. Klotz claims workers who would have otherwise quit their jobs stayed put following the onset of the pandemic. As the economy slowly reopened, individuals acted on their initial urges to leave (and in many cases, sought new work).

Employee burnout. Burnout can be a harbinger of turnover. According to Klotz, increased levels of tension and exhaustion may have inspired employees to move on to greener pastures.

A shift in identities. Klotz claims “pandemic epiphanies” caused many people to take stock of their personal and professional lives. As people looked inward, some felt a calling for more fulfilling opportunities.

Remote work. As businesses reopened, in-person work was called into question. In fact, 91% of remote workers want to retain some remote work, while more than half prefer to split their time between working at home and in an office.

Great Resignation is now a catchall descriptor used to validate, among other trends, why nearly 47 million people quit their jobs in 2021. But it’s worth digging deeper to uncover why workers were leaving and which companies experienced the biggest changes. We found that small and medium-sized businesses witnessed the bulk of labor transfer¹ and flexible work arrangements and comprehensive benefits packages could help reduce turnover.

We’d be remiss to not mention the streak of optimism seen since the turn of 2022. Labor projections seem to be less grim as we crest the two-year mark of the public health crisis. Nearly 700,000 jobs were created in February 2022—shattering initial projections of 400,000—while unemployment rates dropped to 3.8%, inching closer to the pre-pandemic rate of 3.5%. Job Openings and Labor Turnover (JOLTS) data from January 2022 also suggests workers may be less inclined to quit their current jobs for a new one. The number of workers voluntarily leaving jobs was down for the second month in a row.

While we haven’t weathered the storm completely, these trends may suggest an economy in recovery mode. As we march further into 2022, some claim workers may have the upper hand in an economy primed for revitalization. With the gap between open jobs and workers still at historic highs, this employee-centric growth may persist until the labor market bounces back.

The revolving door of turnover and job creation

Data from the U.S. Bureau of Labor Statistics (BLS) highlights a turbulent, yet competitive job market in 2021. According to the BLS, 4.5 million Americans quit their job in November 2021, the highest level ever recorded. On average, nearly four million Americans quit their jobs each month on average that year. Focusing on resignations, however, may not tell us the full story.

As workers put in their two weeks, companies were left to scramble to fill vacant positions—or even create new ones in response to consumer demand surges (overall consumer optimism and spending were also strong in 2021). Despite record turnover, job openings have outpaced unemployment since May 2021. For example, in December 2021, there were 10,925 job openings and 6,319 unemployed workers.

To better describe these trends, alternate names like the Great Reshuffling and the Great Renegotiation have emerged. Semantics aside, as job openings continue to grow as projected—and demand for goods and services continues on an upward trajectory—it’s individual employees who may be left with improved bargaining power. Many individuals are seeking new jobs, while others may be starting businesses or leaving for retirement. It’s not a stretch to assume they’re looking for better pay, benefits, and overall flexibility.

New small business growth

The Census Bureau’s Business Formation Statistics saw a record 5.4 million new business applications submitted in 2021—a staggering increase of 53% from 2019—nearly one-third of which were likely to hire employees. Small business creation is expected to grow, as 17 million employees said they wanted to start their own business in 2022. From there, 5.6 million businesses were projected to file for an Employer Identification Number (EIN), a significant figure when we consider all businesses must request an EIN if they plan to hire employees. This all comes on the heels of a record year for venture capital, in which investments soared to $621 billion (a 111% increase from 2020), which further implies a short-term small business boom.

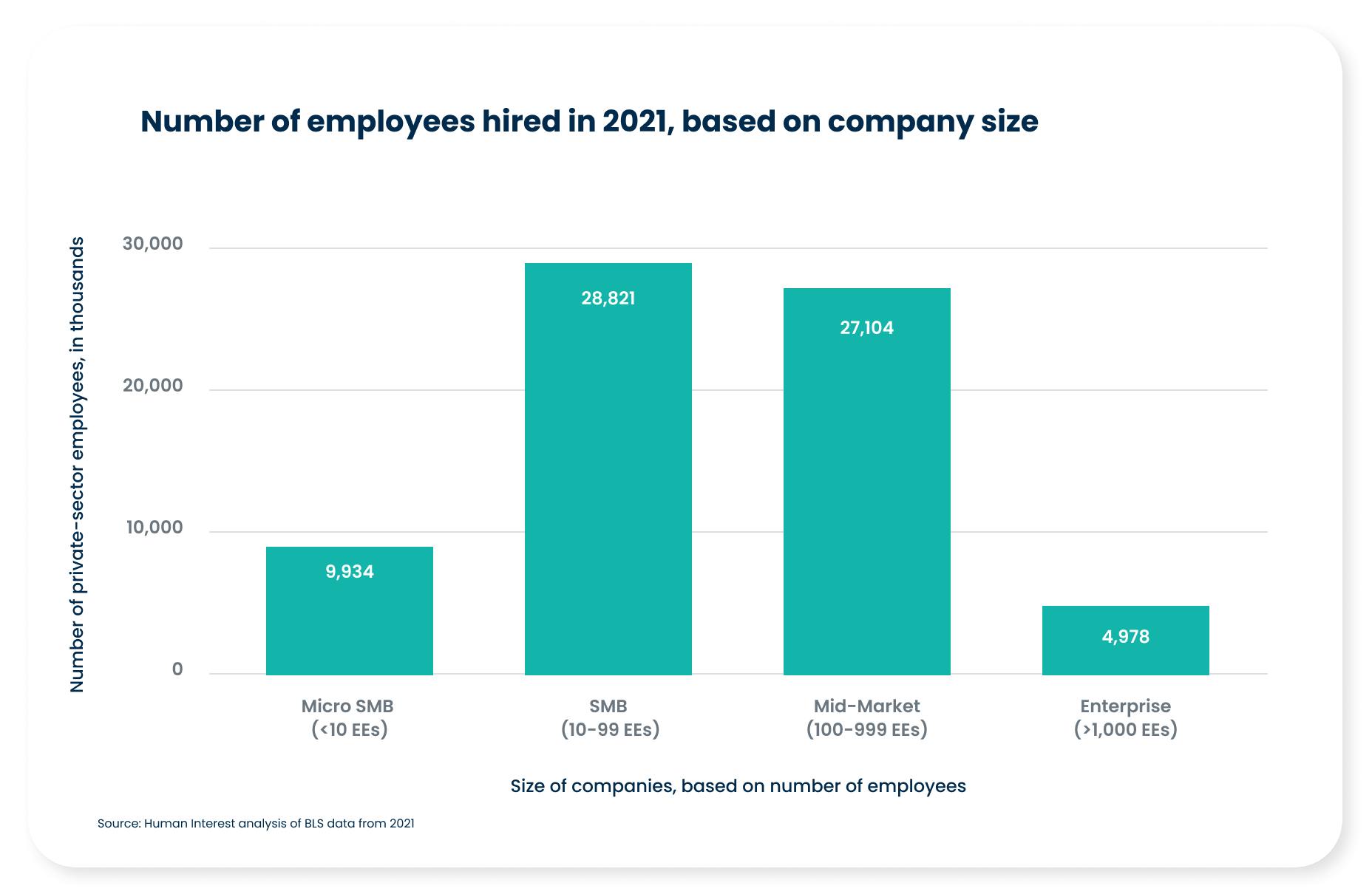

This groundswell in business applications and startup funding underscores the growth of small businesses. That market has seen the most job creation. A Human Interest analysis of BLS data from 2021 found that small and medium-sized businesses accounted for the vast majority of hires in the private sector:

Small and medium-sized businesses (companies with 1-249 employees) accounted for 78% of new job creation (55,234 total hires) in 2021

Of the SMB subset, “micro-businesses” (companies with 1-9 employees) accounted for 14% of all new job creation

Just 7% of new job creation occurred at big businesses (companies with 1000-5000+ employees), despite that sector accounting for 41% of all private-sector employees

Why are employees flocking to small businesses?

Data may suggest a parallel between employee burnout, a preference for remote work, and shifting worker identities. And understanding these intersections may be key for companies looking to recruit, hire, and retain employees in an evolving economy.

A 2021 Owl Labs report surveyed 2,050 remote workers and found nearly half of all current remote workers would look elsewhere if that option was revoked. Additionally, 90% said they were as productive or more productive working remotely, 84% said sustained remote work made them happier, and 74% said remote work was better for their mental health. Pair these findings with the American Psychological Association study that found 79% of American workers had experienced work-related burnout in 2021, and it’s not a stretch to say remote or flexible work options may offer a sigh of relief for many workers.

No longer tethered to one location, flexibility may be key in recruiting and retaining employees. A 2021 study found 88% of knowledge workers said they’d look for one that offers flexibility in location and hours. But this goes beyond flexible work arrangements. It’s also about providing employees benefits they care about. A 2021 survey polled more than 1,000 workers—nearly half of whom were planning to look for a new job in the next year—who claimed that benefits and perks were the top factors they would consider when seeking a new job.

401(k) plans may reduce turnover

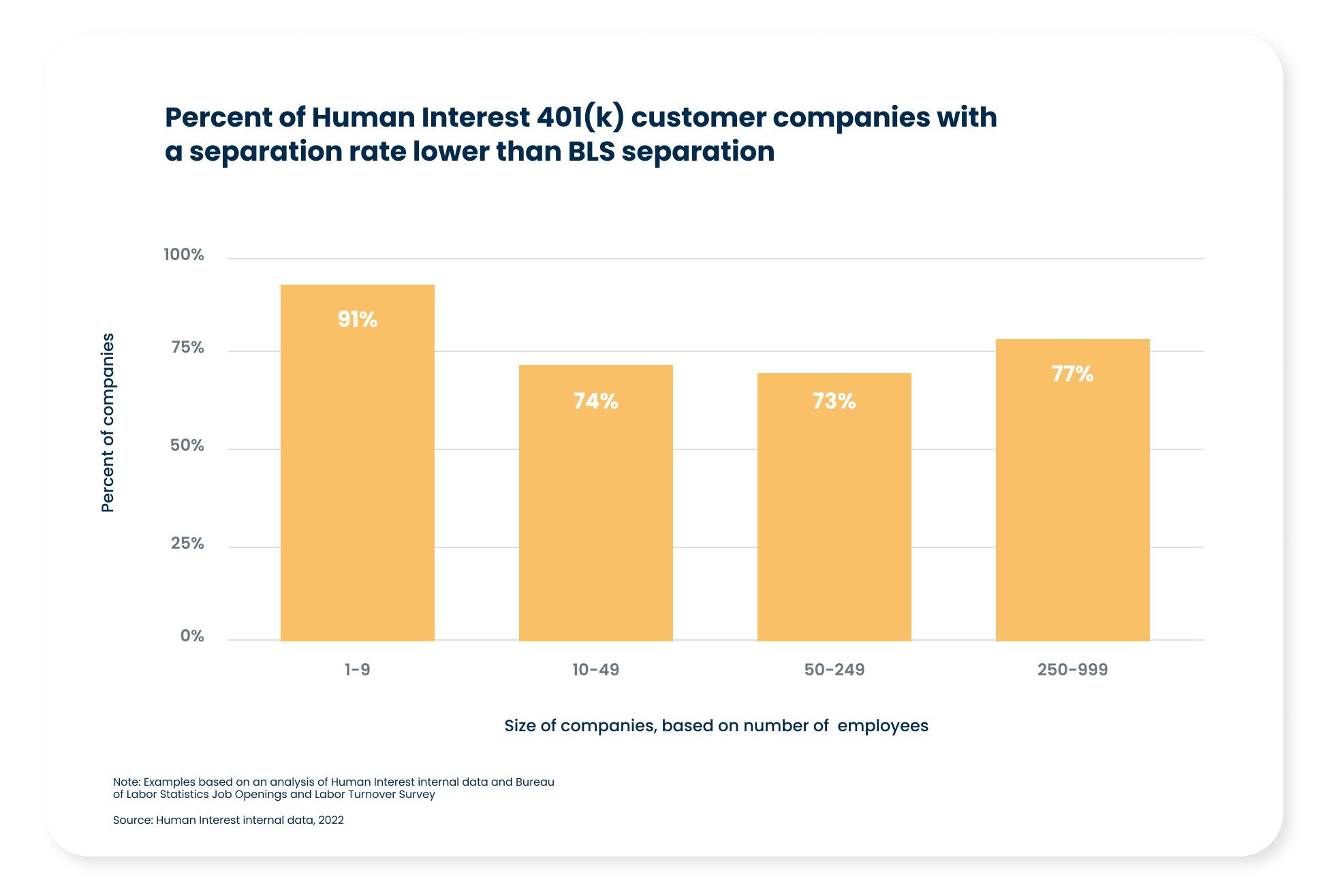

To dig deeper, Human Interest looked to correlate job creation and retention by analyzing monthly turnover from our customer payroll data (which includes new hires and terminations). We then compared monthly turnover rates among our customers to national turnover averages (based on BLS data).¹ We found businesses of all sizes with a Human Interest retirement plan had a lower separation rate in 2021 compared to national average turnover rates.

As this suggests, small to medium-sized businesses that offer a 401(k) plan may have lower turnover rates. With this in mind, it’s worth asking: Are employees more likely to stay with a company if they participate in a 401(k)?

How to recruit and retain employees with retirement benefits

Much like employees are rethinking their work preferences, employers must also reconsider how they’re attracting and retaining talent. Echoing ideas of the pandemic epiphany, McKinsey found nearly two-thirds of U.S. employees said the COVID-19 pandemic caused them to reflect on their purpose in life. This resolve, it turns out, is intrinsically linked to an individual’s career—as 70% of employees said their sense of purpose is defined by work.

A 2019 survey found 60% of employees who feel cared for said they plan to stay at a company for at least three years. In this report, “care” was defined as providing the necessary “health, welfare, maintenance, and protection” of workers. Part of this includes a comprehensive benefits package. In a 2021 survey, employees ranked medical and retirement as the two primary benefits they considered when evaluating a compensation package. In fact, 78% of employees rated a retirement plan as a “must-have” benefit. And what’s more, half of all Americans say they would leave their current job for another with better benefits.

Retirement doesn’t happen overnight. It turns out that people prepare and transition into retirement over a long period. A Human Interest survey found SMB employees are planning, on average, to retire at age 69—an age much higher than the average retirement age of 62. But pre-retirees aren’t only resigning from jobs, they’re looking for the best arrangement for today and tomorrow. Although younger employees may be looking to build a foundation for their future, employees near retirement age may want to shore up the likelihood that they can finance long-held dreams and sustain them over the long haul.

As employers vie for attention in a historic labor market, it’s important to offer flexible retirement plans that help push prospective and current employees down their individualized paths to financial freedom. After all, employers are the top reason employees begin saving for retirement—and workers are 15 times more likely to save for retirement if their employer offers access to a payroll deduction savings plan. While the future of work may still be unknown, it’s safe to say retirement benefits will play a key role in the recruitment and retention of talented employees.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

Trenton ReedTrenton Reed is the Manager of Content Strategy at Human Interest. He has nearly a decade of experience writing for Fortune 500 and SMB companies across finance, technology, and other verticals.