Key Takeaways

State law requires Maine employers to provide a Roth IRA through the Maine Retirement Investment Trust (MERIT), or offer a qualified retirement plan like a 401(k)

The mandatory program has deadlines rolling out in intervals, and businesses that do not comply face the potential of fines

The next deadline on April 30, 2024, requires employers with 15 employees or more to offer the program

In June 2021, Maine signed a bill into law to create the Maine Retirement Savings Program. Under the program, private-sector employers that don’t offer a retirement plan must provide their employees the option to contribute to a Roth IRA from their paychecks. The Pine Tree State is the latest state to address the retirement savings crisis and joins a growing list of jurisdictions that have introduced a mandatory auto-IRA program.

Nearly half of all private-sector workers in Maine—about 235,000 people—do not currently have access to an employer-sponsored retirement savings program, according to AARP data from 2015. Currently, more than one-third of Maine residents age 65 and older depend on Social Security Benefits without any retirement savings. While an auto-IRA program may be a step forward for the state, is it ideal for your Maine business? Read more to find out.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Maine Retirement Savings Program auto-IRA with a 401(k) plan.

Overview of Maine Retirement Savings Program legislation

On June 17, 2021, both the Maine House of Representatives and Senate passed An Act To Promote Individual Retirement Savings through a Public-Private Partnership (LD 1622) with overwhelming support. One week later, on June 24, Maine Governor Janet Mills signed the bill into law. The bill created the Maine Retirement Savings Board to develop, establish, and maintain the program.

An amendment was made to the bill on March 9, 2023. Under this amendment and regulations issued by the Maine Retirement Savings Board, employers with more than five covered employees that don’t already offer a retirement option will have to comply by April 1, 2024.

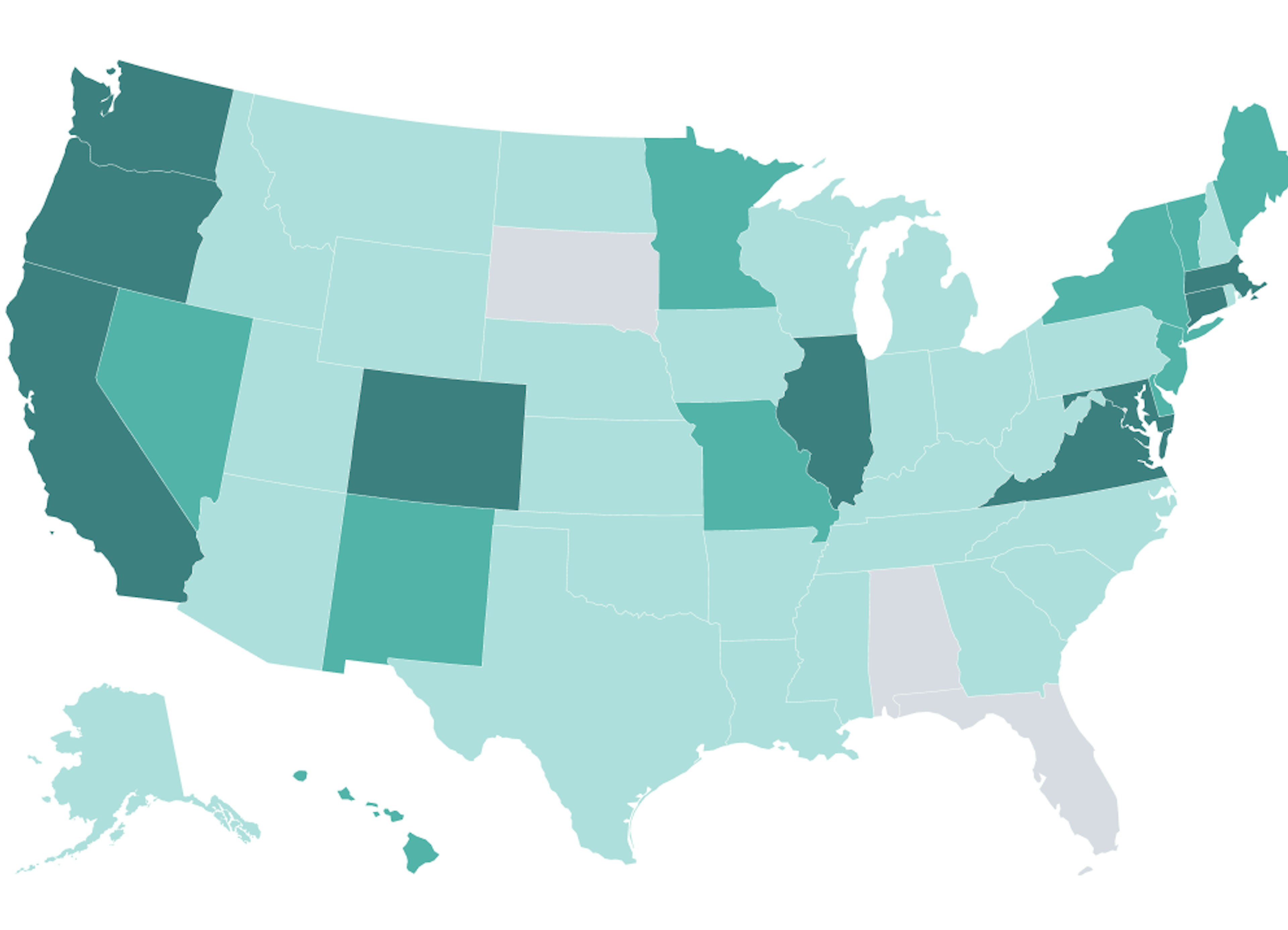

The State Treasurers of Maine and Colorado announced in August 2023, that Maine’s program would join Colorado’s already-operational state-sponsored retirement plan, in a first-of-its-kind partnership. The multi-state IRA plan will reduce the costs for both states’ programs. Colorado Secure Savings and the Maine Retirement Investment Trust will operate independently but share governance responsibilities. (New Mexico is also planning to join the multi-state plan, pending amendments by the state legislature.)

Who does the Maine Retirement Savings Program affect?

According to the bill, a covered employer is a person or entity engaged in a business, industry, profession, trade, or other enterprise that has not offered employees a specified tax-favored retirement plan. This includes for-profit and not-for-profit businesses. Finally, qualifying businesses must have been in operation for at least two calendar years.

A covered employee is an individual aged 18 or older employed by a covered employer and who has wages or other compensation that are allocable to the state of Maine. Currently, this includes part-time, seasonal, or temporary workers; however, the legislation claims that the board may establish future requirements for part-time, seasonal, and temporary employee eligibility.

Learn more about Maine Retirement Savings Program alternatives:

Use our calculator to see how much a 401(k) would cost with SECURE Act tax credits applied.

Read more about the fees associated with launching and maintaining a 401(k) plan for your business.

Deadlines for the Maine Retirement Savings Program

The program is being implemented in phases:

April 30, 2024: Employers with 15 or more employees in Maine must offer the program.

June 30, 2024: Employers with 5 to 14 employees in Maine must offer the program.

Employers with 1-4 employees are not required to offer the program; they may choose to do so.

Penalties for not participating in the state retirement program

According to the amendment from March 2023, the board will enforce penalties on qualifying employers each calendar year (or portion of a calendar year) for failing to enroll an employee without reasonable cause. Penalties go into effect on July 1, 2025, and are as follows:

$20 per covered employee from July 1, 2025, to July 30, 2026

$50 per covered employee from July 1, 2026, to July 30, 2027

$100 per covered employee on or after July 1, 2027

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Maine Retirement Savings Program auto-IRA with a 401(k) plan.

What are the Maine Retirement Savings Program plan details?

Under the bill, private-sector workers would contribute to a Roth IRA through the Maine Retirement Investment Trust (MERIT) from their paychecks. The bill will require employers to provide employees the choice to contribute to a payroll deduction Roth IRA by automatically enrolling them with an opportunity to opt out. Covered employees that do choose to opt out will be automatically re-enrolled with the opportunity to opt out again at regular or ad hoc intervals. While re-enrollment intervals are yet to be determined, according to the most current version of the bill, the amount will not be more frequent than annually.

Below are some important features of the Maine Retirement Savings Program:

Employers will automatically deduct 5% of an employee’s salary or wages to a Roth IRA

Employees may choose to increase or decrease this rate

The annual contribution rate will increase no more than 1% of wages or salary per year (to a maximum of 8%)

As currently written, LD 1622 will provide employee direct deposit into a default investment such as a series of target date funds and limited investment alternatives, including a principal preservation option determined by the board. Companies will not be required to match employee contributions. The Maine Retirement Savings Board could potentially expand the program to include a traditional IRA option. The Roth IRA would follow workers between jobs. Finally, the program currently will allow individuals who are not employees—including self-employed and independent contractors—to participate.

Do Maine small businesses have other options?

Yes! According to the bill, a "specified tax-favored retirement plan" means a plan, program or arrangement that is tax-qualified. This may include a 401(k) or other plans qualified under sections 401(a), 403(a), 403(b), 408(k), 408(p), or 457(b) of the IRS.

What this means is that employers should consider the options. While the lack of an employer match might sound attractive to employers, many employers may be better off providing a match to employer contributions in the form of a 401(k) plan. For example, employer contributions to 401(k) plans are tax-deductible as long as they don’t exceed limits set by the IRS. What’s more, some 401(k) plan administrative fees are also tax-deductible.

If you’re a small business establishing a 401(k) plan for the first time, you may be eligible for even more incentives. The SECURE Act may offer your small business additional tax credits and is currently undergoing some big changes—many of which will positively impact small businesses. We’ll be sure to keep you updated.

Consider the benefits of a 401(k) for your employees

For example, Roth IRA holders can only contribute up to $7,000 ($8,000 if age 50 and over) in 2024 (the same limits apply to traditional IRA). Many employees—including high-earning individuals and those close to retirement age—may be better served by a 401(k), which allows much higher contribution rates. In 2025, contribution limits for employees in a 401(k) plan is $23,500. Employees aged 50 or older can take advantage of catch-up contributions, meaning they can contribute an additional $7,500, for a total of $31,000. Employees aged 60-63 can take advantage of increased catch-up contributions, meaning they can contribute an additional $11,250, for a total of $34,750.

It’s important to weigh your retirement plan options. Not only does a 401(k) potentially provide tax incentives, it can also help your employees save more for their futures. How can a low-cost 401(k) retirement savings plan match the needs of your small and medium-sized business? Human Interest is here to help.

Start a 401(k) with Human Interest

A Human Interest 401(k) plan can connect directly with your favorite payroll provider and has zero transaction fees.*

* Applies to all transaction types. For non-rollover distributions, shipping and handling fees may apply to requests for check issuance and delivery.

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.