Key Takeaways

HB 205 established Delaware EARNS, which is designed to increase retirement access for private-sector employees

Private businesses with 5+ employees without a qualifying retirement plan are required to participate—or offer a qualified plan like a 401(k)

Delaware EARNS is set to be implemented by January 1, 2025

The retirement savings gap in the United States also impacts workers in the state of Delaware. More than half of the First State’s workforce—more than 200,000 people—don’t have an employer-sponsored retirement plan. In a state with an extensive wealth gap (the wealthiest 5% of households in Delaware have average incomes 10.5x the size of the bottom 20%), this lack of access can lead to retirement worries.

Signed into law in August 2022, HB 205 establishes the Delaware Expanding Access for Retirement and Necessary Saving (EARNS) program, a low-cost, portable, tax-favored means of saving for workers whose employers do not offer a private-sector 401(k) or another type of retirement plan. In addition to the goal of closing the wealth gap among “modest wage earners,” the bill’s sponsors hope to attract talented workers to the state.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Delaware EARNS auto-IRA with a 401(k) plan.

What we know about Delaware EARNS

In addition to establishing the EARNS program, HB 205 creates the Delaware EARNS Program Board. The board, responsible for designing, developing, implementing, and maintaining the plan, is also responsible for determining:

Employee eligibility and employer status

Enrollment processes

The methods by which employees or participants make and change elections

Contribution limits, initial automatic default contribution rate, automatic annual default escalation rate, and the maximum default contribution rate

Investment options, including default investment options

The board is expected to disband and transfer duties to the Plans Management Board no later than December 31, 2025. In the meantime, the state Treasurer’s office will hire an executive director to guide the program’s operation and work with the Delaware EARNS Program Board, with the plan set for implementation by January 1, 2025.

Investment options offered through the program include a range of risk and return opportunities that consider the costs, portability, and diverse needs of all participants. As planned, all investment options will be Roth IRAs.

Learn more about Delaware EARNS alternatives:

Use our calculator to see how much a 401(k) would cost with SECURE Act tax credits applied.

Read more about the fees associated with launching and maintaining a 401(k) plan for your business.

What Delaware employers can expect from EARNS

Private businesses that have operated at least six months in the preceding year, have five or more employees, and don’t offer a qualifying alternative retirement plan are required to participate in the EARNS program. While the implementation timeline is yet to be determined, once employers are required to participate, they'll be responsible for:

Registering with the program and providing relevant employee information

Facilitating employee participation and opt-out

Providing employees with program information, educational materials, and disclosures

Remitting employee contributions.

The plan is designed for maximum simplicity for employers and employees with minimal costs in mind. Employers will be prohibited from making contributions to workers’ accounts and will have no responsibility for employees’ decisions to participate or opt out, investment options offered through the program, or participants’ investment decisions or performance.

Deadlines for employer participation will be staggered according to the size of the employer. As designed, employers with the fewest employees will have the most time to establish participation.

The plan is voluntary for workers and they may opt out at any time. However, unless they opt out immediately upon eligibility, they will be automatically enrolled, with the default contribution rate beginning at 3% deducted from their paycheck. Default rates will automatically escalate annually from 1 to 2% every year, until a 15% contribution rate is achieved. Participants can adjust their contributions at any time to any amount.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the Delaware EARNS auto-IRA with a 401(k) plan.

The potential impact of the Delaware EARNS program

There’s already a large disparity in wealth among Delawareans—and yet the situation for the state’s middle-aged and senior populations is expected to decline in the coming decades.

According to an April 2021 Congressional Research Service report, the number of citizens over the age of 65 living in poverty in the state is projected to increase substantially over the next 20 years, with an increase in demand for public assistance benefits. And according to a March 2020 survey by MoneyRates, 36% of employees who are within 20 years of retirement expect the COVID-19 pandemic to delay their retirement.

Similar state-sponsored programs have seen participation rates that average between 60-80% of eligible employees, with contributions of roughly $110 a month. By requiring participation for employers with as few as five employees, the EARNS program would implement a tool that could help boost retirement savings, benefitting a large portion of the state’s workers—experts are estimating around 150,000.

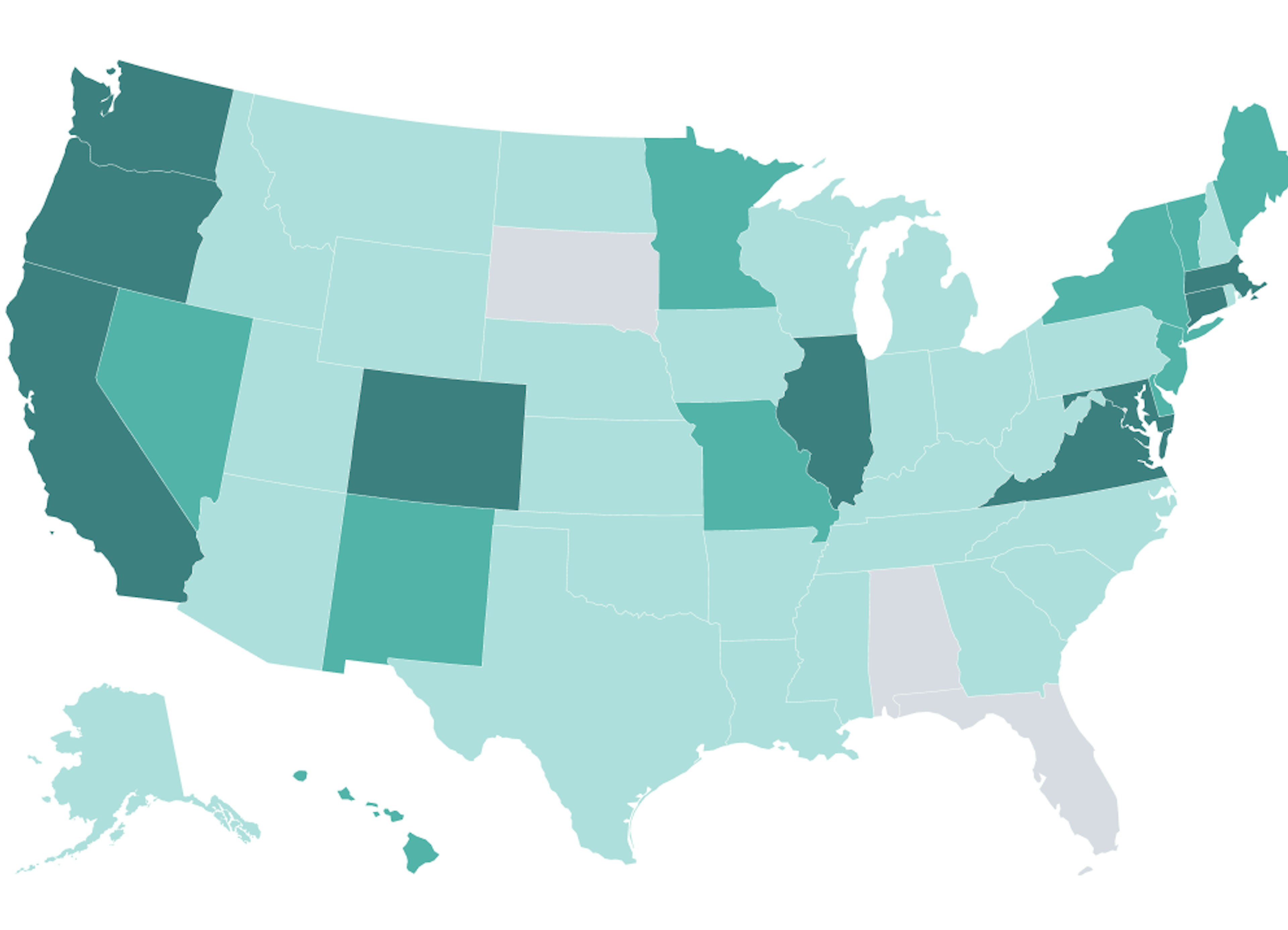

It remains to be seen how Delaware residents will be impacted by the ongoing pandemic or potential recession, but there’s reason to be optimistic about their ability to save despite COVID or other crises. Encouraging statistics from the three longest-running programs (Oregon, Illinois, and California) indicate overall consistency in contributions, withdrawals, and overall plan assets despite the economic downturn caused by the COVID-19 pandemic.

Which retirement plan is right for your business?

While there’s still a lot we don’t know about EARNS program implementation, what’s clear is that many workers in Delaware need a jump start in saving for retirement.

Delaware’s state-sponsored retirement program is specifically designed to help small businesses facilitate retirement savings for their workers—but those that already have a tax-favored plan in place such as a 401(k) would only have to show proof of an existing plan.

If you own or help manage a small business in Delaware and would like to start helping your employees save for a more comfortable retirement sooner than the projected 2025 implementation of EARNS, Human Interest can help you find affordable, flexible retirement plans suited to your needs and budget. By syncing to more than 200 payroll providers, and handling recordkeeping and compliance, we help reduce the manual work of plan administration—so you can focus on running your business. Click here to get started today.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.