Key Takeaways

State-mandated retirement programs offer new business opportunities for financial advisors.

Partnering with a 401(k) provider can enhance client relationships by offering complementary advisory services.

Understanding compliance requirements and program benefits is essential for guiding clients effectively.

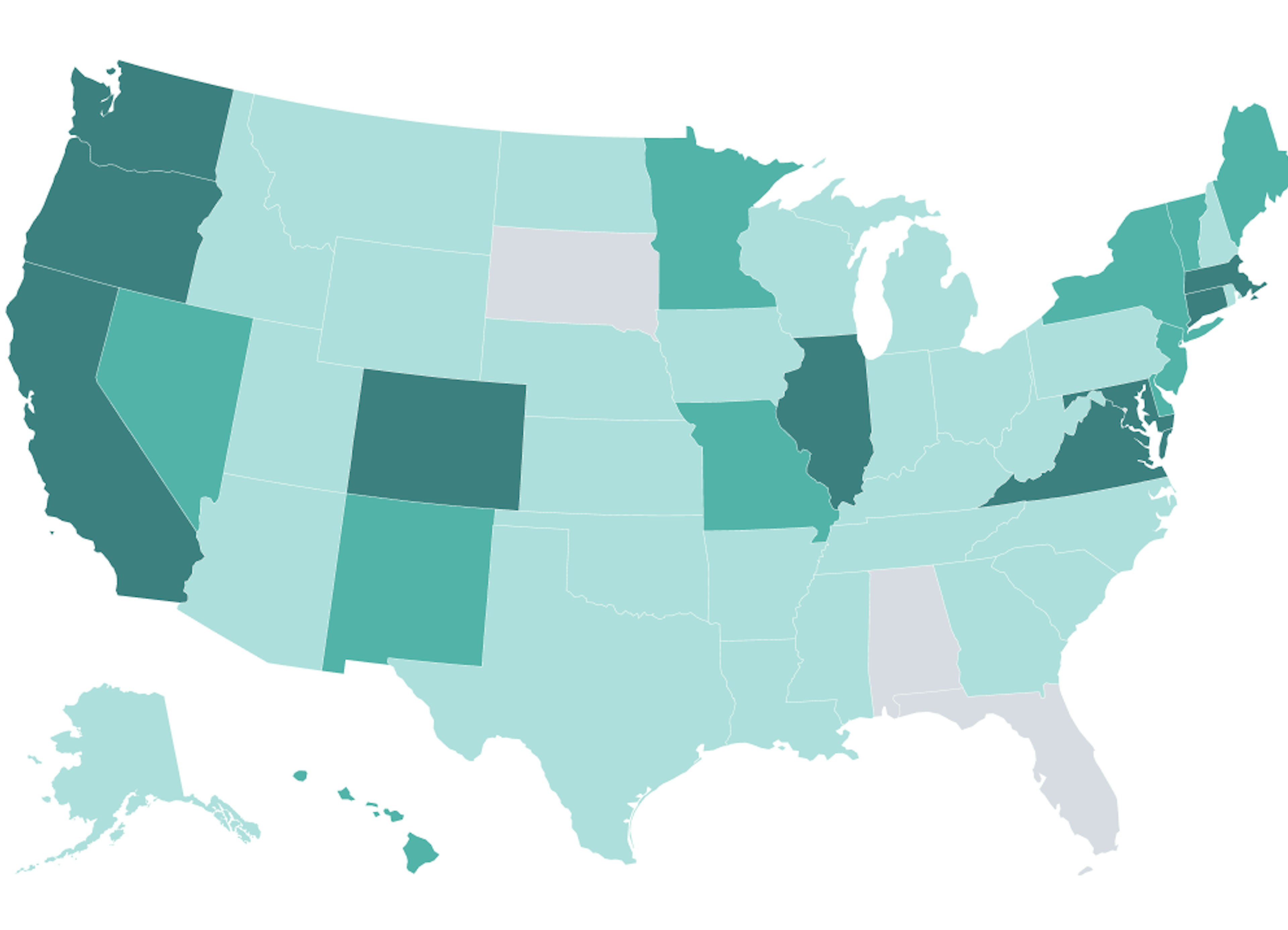

As a financial advisor, you may be aware that state-mandated retirement programs are becoming more prevalent. As a response to the growing retirement savings crisis in the U.S., employers in many states must now legally provide a retirement savings option for employees. Designed to increase access to retirement benefits, these plans give more people the opportunity to build a financial cushion for their retirement years.

But are these state-run programs the best option for your clients?

This article reviews the design of state-mandated retirement plans, compares individual retirement accounts (IRAs) with other employer-sponsored plans like 401(k)s, and provides tips that financial advisors can use to stay ahead.

Comparing state-mandated programs vs. 401(k) plans

As a financial advisor, you’ll likely be asked to explain the differences between different savings options. Most state-mandated programs enable employers to provide eligible employees with access to a Roth IRA. Unless employees opt out, contributions to these accounts begin via automatic payroll deductions. By design, auto-enroll provides an easy and effective way for workers to start saving and can help ensure that more individuals can financially prepare for retirement. Research shows participation rates triple to 91% with auto-enroll compared to 28% with voluntary enrollment.

While state-sponsored auto-IRAs provide a simplified, low-cost way to offer employees retirement savings options, 401(k)s are tax-advantaged retirement savings accounts that also fulfill state mandate requirements. However, the two offer different rules and features for employers and savers. For instance, 401(k) plans offer significantly higher annual contribution limits compared to IRAs.

Benefits of 401(k) plans may include:

Employer matching contributions can substantially increase an employee’s retirement savings.

401(k)s typically offer diverse investment options, including mutual funds, stocks, bonds, and more.

Employers can benefit from payroll tax deductions on contributions to employees' 401(k) plans and may receive tax credits for setting up new retirement plans.

Educating clients on the benefits and obligations of these programs ensures they make informed decisions about participation and integration.

What state-mandated retirement programs can mean for financial advisors

Did you know partnering with a 401(k) provider can help financial advisors attract clients? In light of state mandates, many business owners are weighing their retirement plan options. With an affordable, flexible 401(k) partner, you can expand your client base by offering retirement plan services to small businesses and their employees.

There is an opportunity to provide additional services to your clients to navigate these programs and integrate them with other financial strategies. Additionally, complementary services like retirement planning, investment advice, and financial education can deepen relationships and enhance your value proposition.

However, to effectively serve clients, advisors should stay informed about the specific requirements of both state-mandated programs and 401(k) plans, including:

Employee eligibility

Contribution limits

Deadlines for compliance

Penalties for non-compliance with state-mandated retirement programs

Human Interest has you covered with our on-demand Learning Center designed for employers, employees, and our partners. Stay updated on state-mandated retirement plans here.

What a 401(k) plan can provide your small business clients

As a financial advisor, you can help clients decide what employee savings solution fits their needs. On the surface, low-cost, simple-to-setup state-mandated IRAs may make more sense for some small businesses. However, it’s important to consider the long-term vision of your client’s businesses. With flexible plan design options—including eligibility, employer match, and profit-sharing options—401(k) plans can be catered to growing businesses.

While both 401(k) and state-mandated plans help small businesses offer competitive benefits to boost employee retention and satisfaction, 401(k)s can deliver more significant savings opportunities. And, offering a 401(k) can be more accessible and affordable than your clients think — especially if you are partnered with a modern 401(k) provider.

3 tips for financial advisors

As an advisor, you are trusted to help optimize your clients' financial strategies—that’s why it’s so essential to understand how current legislation affects your jurisdiction and what alternative solutions are available. In the retirement space, it’s best practice for financial advisors to:

Stay informed about state-specific regulations. Review state legislation regularly, attend relevant seminars, and subscribe to industry updates to stay current on program changes and new opportunities.

Periodically review clients’ existing retirement plans. Understand what your clients are utilizing (if any).

Educate clients about their options. From state-mandated auto-IRAs to 401(k) plans, you can assist with integrating savings programs into clients' broader financial plans.

Whether your clients are individuals who may benefit from solo 401(k) plans or businesses with hundreds of employees, understanding state-mandated retirement programs (and other available options) can help you provide comprehensive, informed advice that enhances your value and expands business opportunities. At Human Interest, we make it easy for financial advisors to grow their revenue space with fully bundled, flexible 401(k) & 403(b) retirement plans. Learn more today.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

Trenton ReedTrenton Reed is the Manager of Content Strategy at Human Interest. He has over a decade of experience writing for Fortune 500 and SMB companies across finance, technology, and other verticals.