Key Takeaways

The Connecticut Retirement Security Program was created in 2016 to address the retirement savings crisis.

MyCTSavings opened for enrollment on April 1, 2022 and the first deadline for employers with 100+ employees was on June 30, 2022.

But is MyCTSavings your best choice? Learn how a 401(k) plan may be a better choice than the state-provided IRA option.

Following the actions of other states, including those of Illinois, California, and Oregon, the Connecticut Retirement Security Program (CRSP) was enacted in 2016 to address the retirement savings challenge of workers in the state. At the time, it was estimated that nearly 600,000 workers in the Constitution State lacked access to a workplace retirement plan.

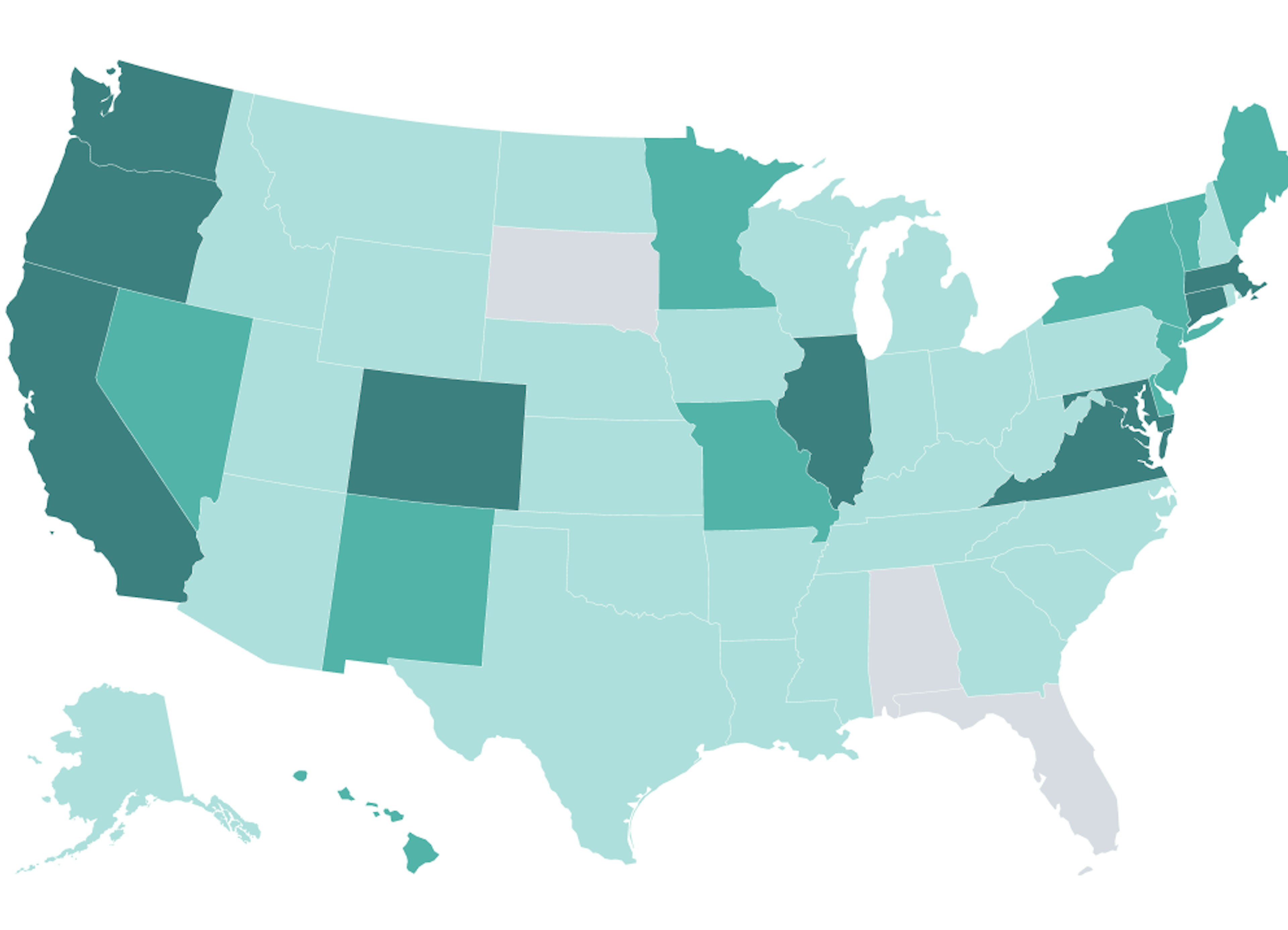

In this article, we’ll focus on the current details of Connecticut’s retirement plan and how it compares to other small business retirement accounts, such as the commonly used 401(k). For an overview of which states have passed mandates and more, be sure to check out our guide on state-sponsored retirement programs.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the MyCTSavings auto-IRA with a 401(k) plan.

What are the deadlines for MyCTSavings?

In August 2021, CRSA launched MyCTSavings, which began in September of that year. Registration for MyCTSavings began on April 1, 2022. All Connecticut employers with five or more employees are legally required to join MyCTSavings or offer a qualified retirement plan if they don’t already have one.

Deadlines are staggered out in the following waves:

6/30/22 deadline: Employers with 100 or more employees

10/31/22 deadline: Employers with 26 to 99 employees

08/30/23 deadline: Employers with 5 to 25 employees

State Comptroller Natalie Braswell estimated that up to 30,000 Connecticut businesses would have to add a retirement plan to comply with upcoming MyCTSavings deadlines.

Is the Connecticut state retirement program mandatory?

Yes. MyCTSavings will be mandatory for employers that don’t already provide a qualified retirement savings plan benefit such as a 401(k). In more detail, any employer, both for-profit and nonprofit, that employs five or more employees who received at least $5,000 in wages during the previous year will be required to comply. However, it doesn’t have to be the state program.

Do qualifying businesses face legal action by not complying?

Yes. If a qualifying business doesn’t register for the program as required by law, “an investigation could occur and there may be penalties,” according to FAQs listed on the MyCTSavings website. There could also be penalties for late or omitted payroll deductions, as failing to remit deductions in a timely manner violates Connecticut law. According to the program, “the State may impose penalties for these violations.”

However, the plan assigns no fiduciary risk to employers and grants employers immunity concerning investments, plan design, and retirement income paid to enrolled employees.

Connecticut’s state-mandated retirement program: The legislation that got us here

Created through Public Act 14-217 in July 2014, the former Connecticut Retirement Security Board (CRSB) performed a two-year study on the feasibility of a state-sponsored retirement savings program. On January 1, 2016, the CRSB presented the results of its market feasibility study and concluded that a plan with a 6% default contribution rate and auto-enrollment would be financially feasible and expected to become self-sustaining between years three and five. The CRSB study suggested the use of traditional and Roth IRA accounts with one investment option aligned with the individual’s target retirement date (in simpler terms, a target-date fund).

Public Act No. 16-29, enacted in 2016, created the Connecticut Retirement Security Authority (CRSA) and disbanded CRSB. A quasi-public agency led by State Comptroller and State Treasurer, the CRSA is the entity responsible for implementing MyCTSavings, the most up-to-date iteration of the state-run retirement plan.

State option or Human Interest 401(k): What's right for you?

Read our free guide to compare the MyCTSavings auto-IRA with a 401(k) plan.

How Connecticut’s state-sponsored retirement plan works

Under MyCTSavings, employers will automatically enroll employees in the state-sponsored plan. Within 30 days of hire, qualified employers will be required to provide each employee with a participation disclosure describing the mechanics of the plan. From that date, employees will have up to 60 days to decide whether or not to opt-out of the plan.

Eligible employees can choose to contribute to Roth IRA accounts (subject to adjustable gross income limitations). Employees that don’t make an election will receive a traditional IRA by default.

Employers aren’t required or permitted to make contributions.

Default contribution rates are set at 3% of total pay, which employees can adjust at any time.

In 2026, total contributions participants can make to both traditional and Roth IRAs can't be more than $7,500 ($8,600 if you're age 50 or older).

MyCTSavings allows participants to invest in various strategic portfolios designed to pursue specific investment goals and Target Retirement Date Portfolios that shift allocation based on expected retirement dates. Each investment option offers a portfolio that consists of various mutual funds each with differing expense ratios and fees (learn more about expense ratios and fees for MyCTSavings).

Employees who are enrolled using default savings choices and do not make specific investment selections will have funds automatically invested in a money market fund for the first 60 days of plan participation. If after 60 days, no action is taken, employees’ funds will be contributed automatically to an age-appropriate Target Retirement Date Portfolio (assuming a retirement age of 65).

Eligibility of employees: Which employees qualify?

Covered employees are those employed by a qualified employer in Connecticut who:

Are of age 19 or over

Have been employed for at least 120 days

Provide services within Connecticut as established in Section 31-222 and not exempt from “employment” as established in Section 31-222(a)(5).

Employees working for an unqualified employer may participate in the plan if their employer chooses to enroll in the program with the CRSA. All part-time, contract and freelance workers may enroll in the Connecticut Retirement Security Program on their own as long as they meet the IRS guidelines. It’s important to refer to modified adjusted gross income thresholds for those choosing to open a Roth IRA. For more information, refer to this IRS table.

What happens if your company already offers a 401(k)?

If your company already offers a 401(k) or other plans qualified under sections 401(a), 403(a), 403(b), 408(k), 408(p), or 457(b) of the Internal Revenue Code, then you don’t need to enroll your employees in MyCTSavings. Still, you should expect to complete some kind of paperwork to notify the State of Connecticut’s Treasury that your business is already offering a qualified savings plan.

The bottom line: Evaluate your workplace retirement plan options

MyCTSavings is just one way that employers can comply with upcoming deadlines—but is it the best option for your business and your employees? Whether you’re an employee or employer uncovered by a retirement plan in Connecticut, you still have time to research all of your options.

Individuals can contribute up to $7,500 ($8,600 if age 50 or over) into a Roth IRA account, compared to a traditional 401(k), which has a higher contribution limit of $24,500 ($32,500 if age 50-59 or 64+, $34,740 if age 60-63). While it may be true that it’s better to start saving for retirement later than ever, it may be better to set up an account that allows eligible employees to maximize contributions.

Want to discuss the advantages of providing your employees a 401(k) plan instead of a state-provided Roth IRA? Contact Human Interest today.

Here are some additional resources to help you evaluate your options:

Start a 401(k) with Human Interest

A Human Interest 401(k) plan can connect directly with your favorite payroll provider and has zero transaction fees.*

* Applies to all transaction types. For non-rollover distributions, shipping and handling fees may apply to requests for check issuance and delivery.

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.