Key Takeaways

The law mandating the creation of the Nevada Employee Savings Trust Program (NEST) passed in June 2023.

Employers with 6+ employees must auto-enroll eligible employees in the state program or a qualified plan such as a 401(k).

Business registration is projected to begin in June 2025, while the NEST Program is expected to launch by July 1, 2025.

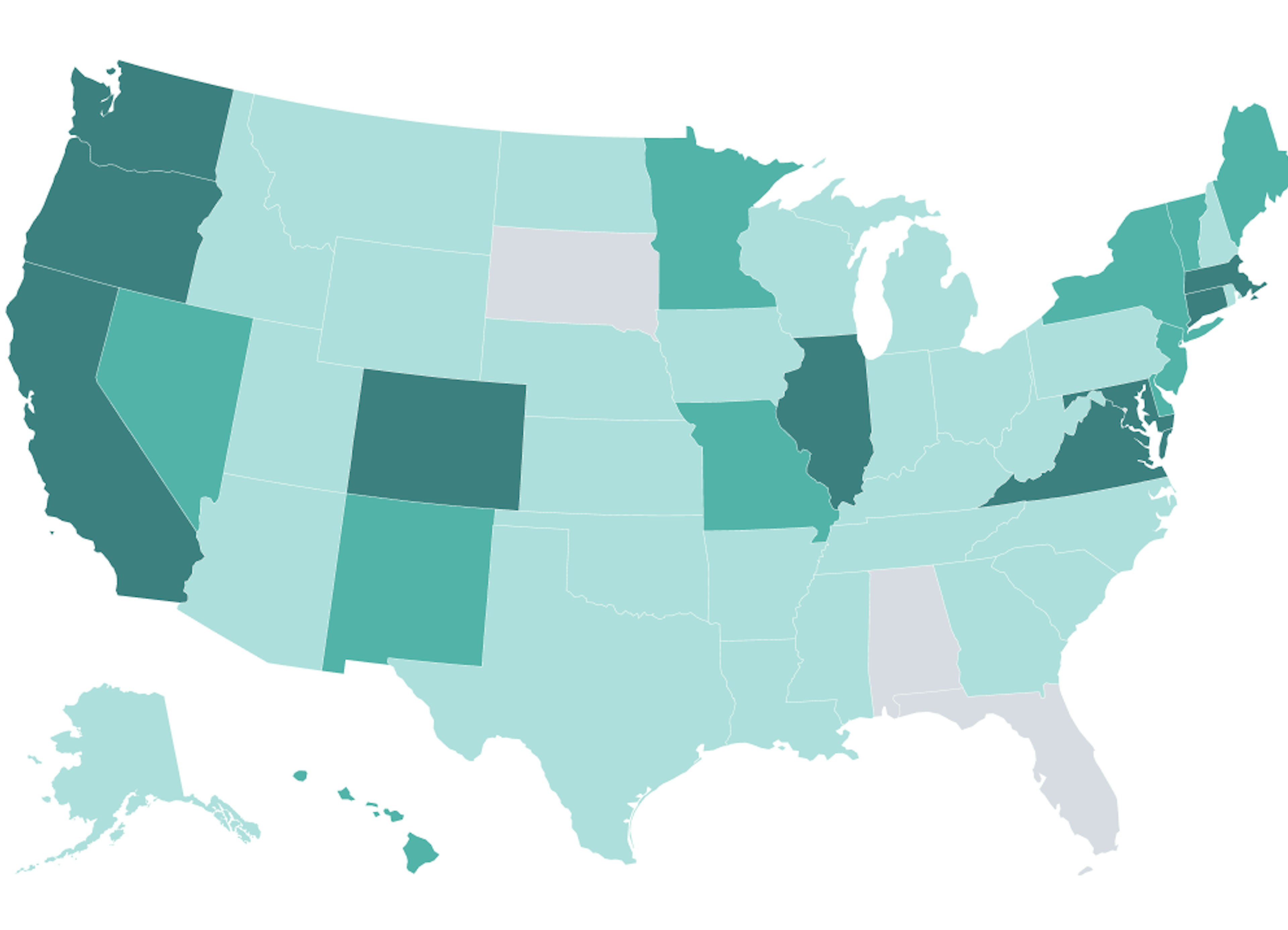

In June 2023, the Nevada Assembly passed SB305 into law, making Nevada the tenth state to pass legislation creating a state-sponsored retirement plan. The Nevada Employee Savings Trust (NEST) is a state-facilitated retirement savings program targeted to private-sector employers who do not offer an employer-sponsored 401(k) or pension plan. It aims to provide a way for employees to save for retirement, with facilitation support for participating businesses.

The objective of NEST is to offer Nevadans a method for retirement savings. The program does this by offering automatic enrollment and payroll deductions through an individual retirement account (IRA), although employees may choose to opt out. Businesses that meet specific criteria will be required to offer NEST or a qualified retirement plan such as a 401(k).

As of mid-2025, Nevada began implementing the NEST program. Employers with six or more employees who’ve been in business for at least 36 months must register by September 1, 2025, if they don’t already offer retirement benefits. Read more to learn about the NEST program and your options, including 401(k) plans.

Nevada state retirement savings program for employers

Employers with six or more employees who have been in operation for at least 36 months and do not currently offer a qualified workplace retirement plan, such as a 401(k) plan, will be required to participate in the NEST program (or a comparable program offered through a chamber of commerce or trade association). The registration deadline for employers is September 1, 2025. NEST will initiate contact with eligible businesses to facilitate registration and provide informational resources for employees.

As proposed, NEST will be a state-facilitated, automatic Roth IRA-based retirement program, meaning that eligible employees will be automatically enrolled in the program. Employees who meet eligibility criteria—including employment for at least 120 days and being 18 years or older—are automatically enrolled and may opt out of the program. Contributions will be defaulted at 5% of earnings and directly transferred from paychecks into a Roth IRA, although employees may adjust their contribution rate. Employers are not required to contribute money to these accounts.

The NEST program requires employers to send payroll contributions and maintain accurate employee records, including updating contribution rate changes, adding new employees, and listing former employees as terminated from employment. Employers are not considered fiduciaries in relation to the accounts and have immunity from civil liability for decisions made by employees or the board of trustees for NEST.

The board of trustees will release communication materials and required disclosures for employers to give to employees, such as:

A description of the benefits and risks associated with making contributions through NEST.

Instructions about how to obtain additional information about NEST.

A description of the federal and state income tax consequences of having a Roth IRA.

A statement that employees seeking financial advice should contact their own financial advisors, and that covered employers are not liable for decisions covered employees make concerning NEST.

A statement that NEST is not an employer-sponsored retirement plan.

A statement that an employee’s Roth IRA established or maintained through NEST is not guaranteed by the state.

A description of the default contribution rate, any automatic escalation rate or frequency, and the employee’s right to make no contribution or change the contribution rate.

A description of the default investment fund.

Retirement law in Nevada: You have options

If you’re a Nevada business without a retirement plan, now is a good time to start thinking about how you’ll comply with the upcoming law. While potential fines and deadlines are still forthcoming, you can comply today by offering a 401(k) plan. From an employer's perspective, a 401(k) plan may be more compelling than an IRA, particularly when considering tax incentives and strategies for employee retention.

The SECURE 2.0 Act offers tax credits to businesses offering 401(k)s, including a startup cost tax credit that can cover a substantial portion of administrative and employee education expenses for new plans, an employer contribution tax credit providing up to $1,000 per employee annually, and a credit for implementing auto-enrollment features.

Beyond these financial gains, a 401(k) provides the option to make employer contributions, which can be a powerful tool for attracting and retaining talent. Combined with higher contribution limits, a 401(k) can boost a company's competitiveness in the labor market, potentially fostering greater employee loyalty and reducing turnover compared to solely relying on state IRA options.

Human Interest offers affordable, automated retirement plans that consider the needs of all businesses and their employees. Click here to get started today.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

Trenton ReedTrenton Reed is the Manager of Content Strategy at Human Interest. He has over a decade of experience writing for Fortune 500 and SMB companies across finance, technology, and other verticals.