Key Takeaways

California businesses with 1+ employees are legally required to register for the state-sponsored retirement program, unless they offer a qualified retirement plan.

The most recent deadline, in June 2022, required companies with 5+ employees to offer a qualified plan—or face fines.

But is CalSavers your best choice? Learn how a Human Interest 401(k) plan may outperform the state-provided IRA option.

If you’re a California business owner, you've probably heard about the CalSavers retirement savings program. The most recent registration deadline, in June 2022, affected employers with more than five employees, who will face fines if they don’t register with the state option or claim an exemption from the program by offering a qualified retirement plan. In August 2022, SB 1126 was signed into law, expanding that requirement to include employers with at least one eligible employee, excluding sole proprietorships and self-employed individuals.

| Deadline | Employee Count |

|---|---|

| September 30, 2020 | Deadline for companies with 100+ employees. |

| June 30, 2021 | Deadline for companies with 51 to 100 employees. |

| June 30, 2022 | Deadline for companies with 5 to 50 employees. |

| December 31, 2025 | Deadline for companies with 1 to 4 employees |

The goal of CalSavers is to help ensure California workers have a path to financial security in retirement. But is it the easiest, most cost-effective way for them to save over the long term? Let’s review the purpose of CalSavers and how it compares to other retirement savings options.

CalSavers isn’t your only option

Learn more about staying compliant with a Human Interest 401(k)

What is CalSavers? California’s retirement savings program

CalSavers, formerly known as Secure Choice, is the state of California’s retirement savings program for the millions of private-sector workers who don’t currently have a way to save for retirement at work. The program is designed to have no employer fees, no fiduciary liability, and fewer overall employer responsibilities. Legislation that created CalSavers stipulates employers must offer a retirement savings plan. If there’s no workplace retirement plan in place, businesses must offer their employees CalSavers, the state-operated retirement savings plan — or else face fines. The plan has a strong focus on small businesses, including employers with at least one employee.

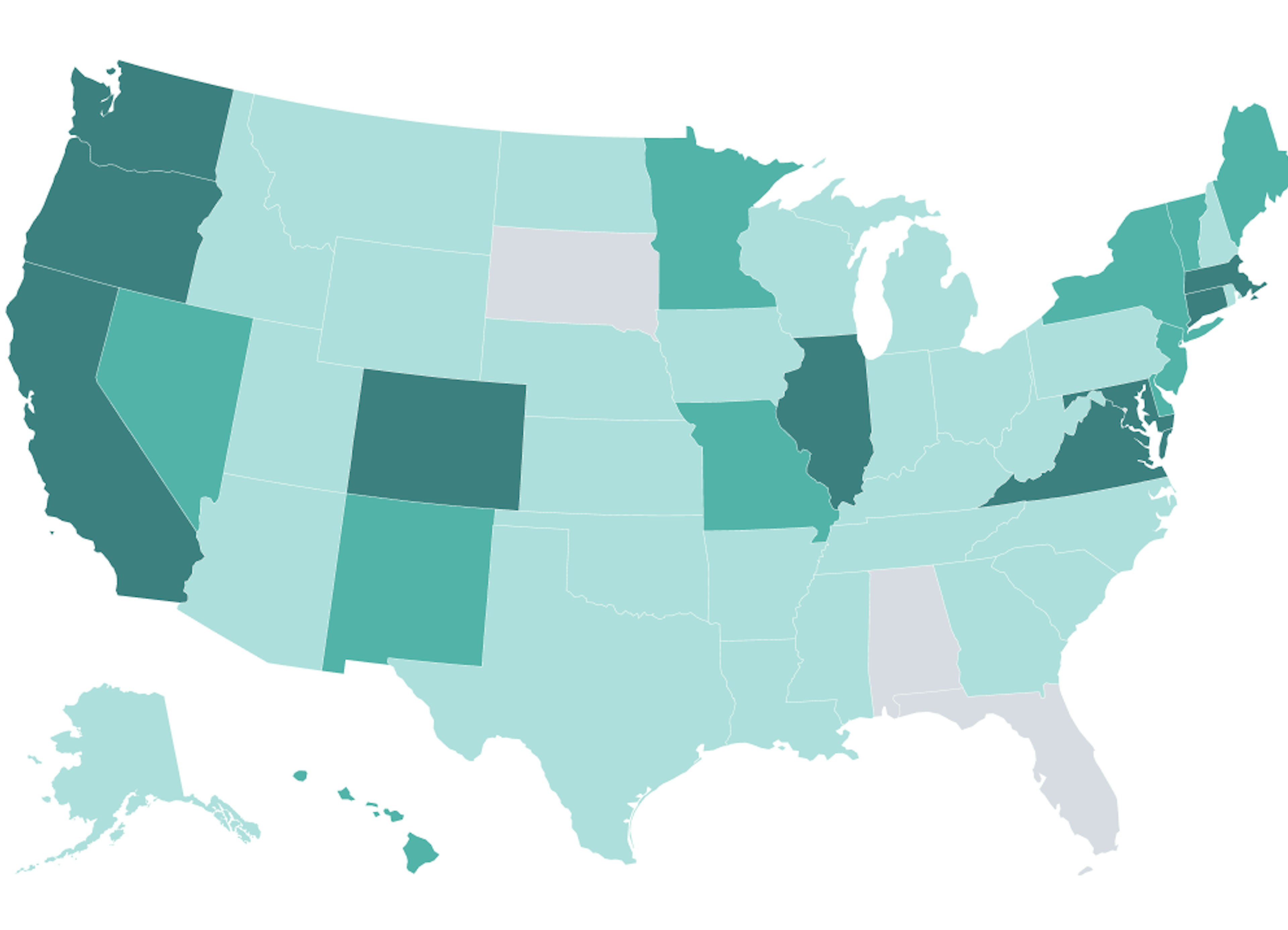

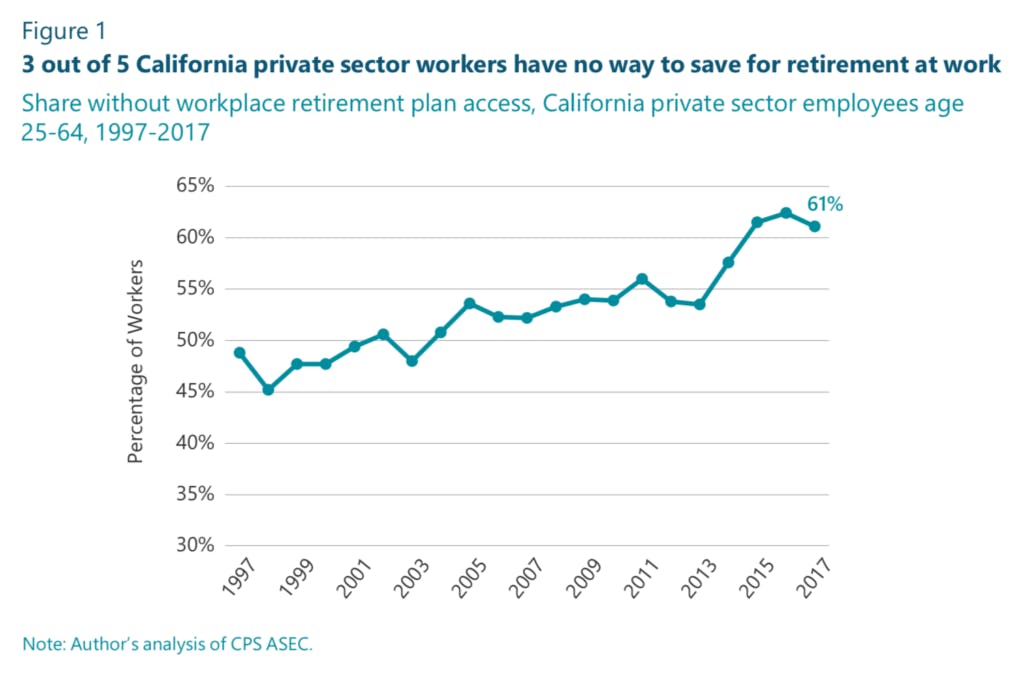

California is one of 46 states that have considered or passed legislation establishing state-run retirement savings programs. 7.4 million California workers aged 25-64 lack access to the most common tools to help them save for retirement. Put another way, 61% of private-sector workers aged 25-64 have no way to save for retirement through their employer, according to 2014 data from the University of California, Berkeley’s Labor Center:

How does the CalSavers program work?

CalSavers provides employers with a way to set up an individual retirement account (IRA) for each eligible employee. While many retirement savings plans offer more flexibility, the state-sponsored option requires companies to use these default features:

Employee payroll deductions are automatic and adjustable — and employees may opt out of the program. Employee deductions are automatically set to 5% of an employee’s gross pay (similar to other state retirement plans). And employees can adjust their contribution setting to a higher or lower percentage of their pay. However, employees can opt out of the state retirement savings program.

CalSavers is a Roth IRA program. Employee deductions are placed into a Roth IRA (although participants may re-characterize their contributions to a Traditional IRA). A Roth IRA comes with an annual contribution limit of $7,000 in 2025 ($8,000 if age 50 or older). High-earning employees are subject to a reduced contribution limit.

CalSavers is portable. If an employee changes jobs, they can keep their CalSavers account—and the plan is designed to move with an employee throughout their working life.

Employee investment options. Unless an alternate investment is selected, all contributions made in the first 30 days are deposited to the CalSavers Money Market Fund. After that point, funds and future contributions are automatically allocated to a target-date fund based on age or expected year of retirement, or to a fund the participant chooses.

Is CalSavers mandatory for employers to register?

After June 2022, all employers in the state with at least five W-2 employees must provide a qualified retirement savings plan—such as a 401(a), 401(k), 403(a), 403(b), 408(k), 408(p), or 457(b), to their employees—or offer the state-run option.

Updates to SB 1126 in August 2022 extended the compliance period for employers with 5+ employees to enroll new employees to 36 months (from 12 - 24 months). Eligible employers will face fines if they fail to offer a plan after this timeframe.

Learn more about CalSavers alternatives:

Use our calculator to see how much a 401(k) would cost with SECURE Act tax credits applied.

Read more about the fees associated with launching and maintaining a 401(k) plan for your business.

What is the deadline for employers to register with CalSavers?

Deadlines to register businesses with more than five employees have already passed.

The most recent deadline on June 30, 2022, required employers with 5+ employees to offer a plan.

Businesses with 5+ employees should register immediately to avoid any additional fees.

Newly mandated businesses with five or more employees are required to register by the end of the calendar year in which they become subject to the mandate (e.g. due to employing five or more employees or because they ceased to sponsor a retirement plan). CalSavers will notify these eligible employers when they determine their eligibility.

For employers with 1-4 employees, legislation will be staggered out slowly — although employers can register at any time before the deadline, which is slated for December 31, 2025.

What if my employer doesn’t comply?

Employers who don’t offer a plan by the deadline may face financial penalties. According to California state law, the CalSavers Retirement Savings Board will issue a “notice of penalty application” to each employer who fails to register for the program. Employers are subject to a penalty of $250 per eligible employee if noncompliance extends 90 days or more after the notice. If found to be in non-compliance 180 days or more after the notice, the employer is responsible for an additional penalty of $500 per eligible employee.

What are my CalSavers investment options?

CalSavers is an automatic enrollment payroll deduction IRA that offers a variety of investment options. Unless participants select otherwise, initial contributions are automatically invested in the CalSavers Money Market Fund. A money market fund invests in low-risk investments such as Treasury securities and often emphasizes safety over profits.

After 30 days, contributions are allocated to a CalSavers Target Retirement Fund based on age and other factors. Participants can also elect to invest in other investment options, such as:

An environmental, social, and governance fund that invests in equity securities of global companies with sustainable business practices

A core bond fund composed of the U.S. investment-grade bond market

Global equity funds that invest in an index of domestic and foreign equity markets

A money market fund that aims to preserve capital and invest in dollar-denominated securities

CalSavers isn’t your only option

Learn more about staying compliant with a Human Interest 401(k)

What are the pros and cons of CalSavers for employers?

The argument for CalSavers — or any state-mandated retirement plan — is that it improves accessibility. However, it’s still up in the air whether state-mandated retirement plans have improved rates of retirement savings among employees who previously did not have access.

Data from the CalSavers Retirement Savings Board show that elements of the state-run program have benefited certain small businesses and their employees. For example, in 2021, the number of active participants in CalSavers more than doubled to 218,000 total savers who were contributing a total of $187 million (excluding withdrawals and investment returns). Plus, registered employers offering the state option tripled to more than 23,000 that year.

Despite these increases, other data points suggest prevailing discrepancies:

The average contribution rate was just $150 per month per participant (despite a total contribution level of $16 million among active accounts per month in 2021). In comparison, participants in Human Interest 401(k) plans contribute 8.7% of their gross income, on average*.

58% of funded accounts had balances of $500 or less at the end of the year (among new savers).

Plans saw an opt-out rate of about 30% among participants, which is higher than the averages of similar 401(k) plans. For example, Human Interest sees participation rates of 87% when auto-enrollment is included in 401(k) plan design*.

Offering your employees CalSavers may be better than providing no retirement plan at all. But it may lack the flexibility and plan design options that your employees deserve:

While CalSavers offers investment options, its funds only represent a fraction of the open market.

CalSavers charges participants between 0.825% to 0.99% in asset-based fees.

CalSavers offers a Roth IRA option, which for 2025, allows contributions up to $7,000 if you earn $165,000 or less per year ($246,000 if married filing jointly). You can also add catch-up contributions of $1,000 more—up to $8,000 in total—if you are age 50 or older.

Is CalSavers the only option for employers?

No. While CalSavers is an affordable, convenient way to handle retirement for your employees, it’s important to know that you have other options. There are many retirement providers out there, new and old, who offer a range of products, including retirement savings options such as IRAs, employer-sponsored retirement plans like 401(k)s, defined benefit pensions, and more. However, only a few retirement plans are custom-built around the needs of small-to-medium businesses.

As an employer, you want to offer your employees tools that help them save for their future. Before deciding what kind of coverage you want to offer your employees, it’s important to weigh your options and understand your needs.

CalSavers isn’t your only option

Learn more about staying compliant with a Human Interest 401(k)

Finding the right retirement plan for your company

Common retirement options include IRAs and employer-sponsored retirement plans such as 401(k)s. To date, IRAs have been available to anyone through a bank or financial institution, but increasingly, through state-mandated programs like CalSavers, they’re being offered through employers. However, compared to an IRA, a typical 401(k):

Can let you save more money each year through a higher contribution rate (compared to an IRA)

Offers contributions that could reduce your taxable income (since contributions are made pre-tax)

Has no eligibility restrictions in terms of household income

May incur tax benefits for both employees and employers

Read more about the differences between an IRA and a 401(k).

The CalSavers program is just one way to comply with state retirement mandates. However, it’s important to shop around and research all of your options to make the best financial choice for you and your employees.

Want to explore the advantages of offering your employees a 401(k) benefit instead of the state retirement plan? Get started today.

CalSavers isn’t your only option

Learn more about staying compliant with a Human Interest 401(k)

Article By

The Human Interest TeamWe believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401(k) to your employees. Human Interest offers a low-cost 401(k) with automated administration, built-in investment education, and integration with leading payroll providers.