Key Takeaways

You may not realize you’re paying specific 401(k) fees, as we think specific legacy providers like ADP aren't transparent about their fee structures

For example, transaction fees can cost the average employee hundreds of dollars over a lifetime of working

In a hypothetical scenario, we found that revenue-sharing fees could cost participants roughly $70,000 in retirement savings over the span of a career

Explore the importance of benchmarking your plan fees and how to calculate how much your plan really costs.

Choosing the right retirement plan provider can potentially save small business owners and employees thousands of dollars in fees over a lifetime.

According to our calculations, transaction fees alone can cost the average employee hundreds of dollars over a lifetime of working. This doesn’t even include “revenue share” fees, which some legacy providers receive as part of an agreement with fund companies. For example, if a legacy provider earned 0.80% in revenue sharing fees, that could hypothetically cost participants roughly $70,000 in retirement savings over the span of their career.

However, you may not realize you’re paying these fees. Specific legacy 401(k) providers, like ADP, don’t just charge “standard” fees for a 401(k) plan (which we consider to be asset management and administration/recordkeeping fees). Some legacy providers receive compensation from revenue-sharing fees (e.g., 12b-1 fees) that are baked into the expense ratio of some share classes, while many charge transaction fees to employers and their employees.

Are you overpaying in 401(k) plan fees?

Download our free guide that explores the importance of benchmarking your plan fees and how to calculate how much your plan really costs.

At Human Interest, a modern retirement plan provider, we believe our fee structure is more competitive than legacy providers. Human Interest charges 0.72% in annual assets under management, compared to ADP’s 0.67% annual asset fee. If a plan chooses funds with 12b-1 fees, Human Interest rebates those fees to the plan to offset plan expenses. And we never charge transaction fees to participants.

You could be paying tens of thousands of dollars more in fees

Revenue-sharing fees are baked into the expense ratio of an investment and are used to pay a third party such as a recordkeeper or advisor/broker. These fees may be tucked away in fee disclosure documents that can be complicated to understand without a financial advisor. They may often be overlooked because they’re factored into the share costs. Some legacy providers receive these fees as additional compensation as part of an agreement with the fund company.

Because revenue share fees essentially increase your mutual fund expense ratio, they can make a meaningful dent in your employees’ retirement savings over a lifetime. To help illustrate just how much revenue share fees can affect your future savings, let’s consider a hypothetical example.

Based on our calculations using the methodology noted below, by eliminating the revenue share fee, this individual could hypothetically save almost $70,000 more in retirement savings compared to what they could hypothetically save if they had to pay the 0.80% revenue share fee.

Figure 1

Source: Human Interest calculations. Methodology: Assumes an individual contributes $4,000 annually, with compounding occurring annually, over 40 years. Assumes a 7% annual market return and is adjusted to account for 3% inflation. Hypothetical illustration for informational purposes only. Ending values do not reflect the effects of taxes, assets under management fees, other fees (aside from 12b-1) or investment expenses; if they did, results would be lower. Earnings and pre-tax contributions are subject to taxes when withdrawn. Distributions before the age of 59 1⁄2 may also be subject to a 10% IRS penalty. Does not reflect the performance of any Human Interest account or any actual investment. There is no guarantee that the assumed rate of return will be achieved or that any systematic investing plan will be successful. Actual results will vary. Investing is subject to risk, including the risk of loss. This graph shows our projection of how much 12b-1 fees can eat into retirement savings over a lifetime. Note: 12b-1 fees are capped at 1% by FINRA and we have chosen 0.80% to represent a 12b-1 fee that is on the higher end of the spectrum. Actual 12b-1 fees charged by mutual funds may be higher or lower.

Fees: The difference between legacy and modern retirement providers

For years, certain providers have earned additional compensation from mutual fund revenue share fees. Revenue share fees are commissions paid to individuals or companies who sell the funds in your plan. The commissions may go to your advisor, broker, or 401(k) recordkeeper. Because the 12b-1 is part of the expense ratio, you won’t necessarily know how much you’re paying—unless you or your employees read the prospectus or your plan’s fee disclosure, which details those fees.

12b-1 fees are part of the mutual fund expense ratio, or the percentage you pay for your investment in a fund. 12b-1 fees can vary depending on the share class that you’ve invested in. For example, if you invested $1,000 into a fund and the expense ratio is 0.1%, you’ll pay $1.00 to own that fund for the year.

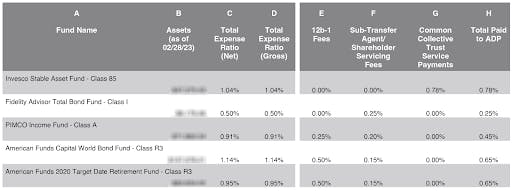

Below is an actual example of a real Human Interest customer’s ADP fee disclosure document to help illustrate how much funds may be charged in 12b-1 fees. As you can see in column E, the 12b-1 fees range from 0.00% to 0.72%.

Figure 2

As of 2/28/23. This is a screenshot showing 12b-1 fees (and other fees) from an ADP fee disclosure document from a real Human Interest customer. Please note, the fees are subject to change. To the extent specific securities are mentioned above, it should not be construed as a recommendation to buy or sell any investment. Consult a financial professional regarding your personal situation before making any investment decisions. This is contrary to some modern retirement providers like Human Interest.

At Human Interest, in cases where a fund offered on our platform charges a 12b-1 fee, we rebate it back to the plan to help pay plan expenses and we do not keep the commission received from the fund. Additionally, we generally recommend mutual funds that do not charge any 12b-1 fees. This allows your employees to save the money that they may otherwise be paying towards 12b-1 fees and therefore, they have the potential to have more money saved at retirement.

Watch out for transaction fees

In addition to 12b-1 fees, some legacy providers also charge transaction fees. Transaction fees may be charged to employers and their employees by retirement plan providers for services like amending the plan document, taking a distribution, or initiating a loan. These fees are often levied at times of hardship, such as dividing up assets during a divorce or dealing with loans.

Some retirement plan providers may charge more than 20 different types of transaction fees, including when employees divide assets during divorce (up to $500), apply for a loan (up to $325), and roll over funds between jobs (up to $100). That’s money that could be going back to your retirement savings and compound over time, which is why we don’t charge any transaction fees.

Avoid costly fees for you and your employees

We believe that selecting the right retirement plan provider can make the biggest difference in saving more for your employees’ retirement experience. If a retirement plan provider is not transparent about their fee structures, chances are you and your employees may be paying more in fees than you were aware of, such as 12b-1 and transaction fees.

At Human Interest, we believe that small businesses shouldn’t be charged unnecessary fees. Our pricing is transparent to both you, the employer, and your employees. You can learn more about how much we charge compared to our competitors by downloading our free benchmarking report or talking to a retirement specialist today.

Low-cost 401(k) with transparent pricing

Sign up for an affordable and easy-to-manage 401(k).

Article By

Zoe WeisnerZoe Weisner is a content marketing manager at Human Interest. Zoe has spent the majority of her career in the B2B fintech space, with half a decade of experience writing content about small business, banking, and personal finance.