401(k) for Small Business

401(k) plans trusted by 20,000+ SMBs.

Get a customized, full-service retirement plan with transparent pricing and zero transaction fees.

401(k) plans are complex. Let Human Interest guide you.

Get guidance on 401(k) plan administration, IRS testing, and government filings with expertise from Human Interest.

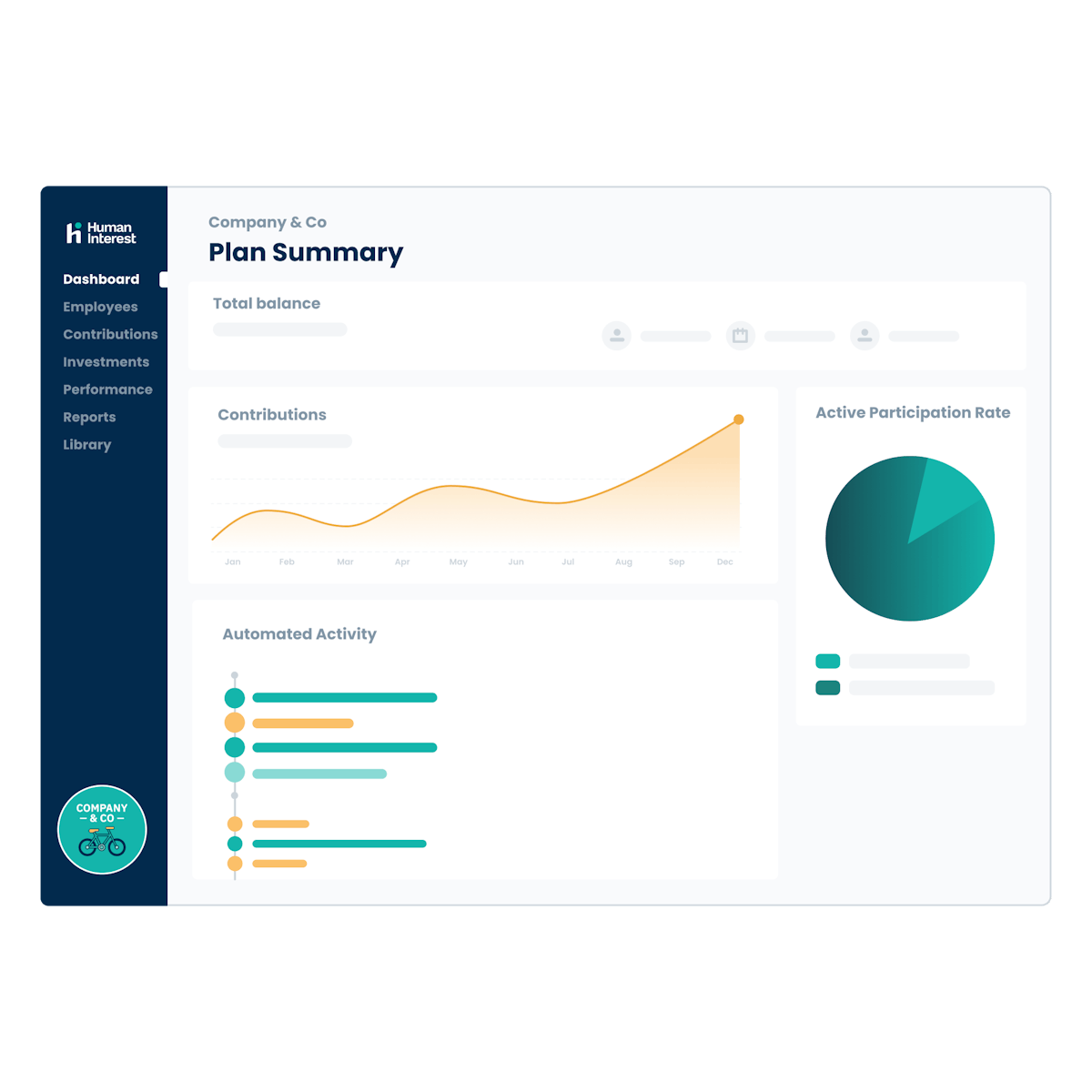

In-house recordkeeping

Automated plan administration tracks participation, contributions, distributions, and more.

Regulatory support

We provide support by preparing select government filings. And for some clients, we sign and file the Form 5500.1

On-demand reporting

Get a 360-degree view of your plan, access reports, and see which employees have joined.

Plan compliance & testing

Don’t stress about IRS testing and regulatory deadlines. We’ll help handle them for you.

A 401(k) may be more affordable than you think.

Human Interest plans come with transparent pricing—and zero transaction fees.

Monthly pricing starting at only:

base fee

per eligible employee

An investment advisory fee is paid to Human Interest Advisors (HIA) of 0.01% of plan assets and a separate fee for recordkeeping services and custody-related expenses is paid to Human Interest Inc. (HII) of 0.05% of plan assets. Both fees are deducted on a monthly basis from the employee's account according to the HII and HIA Terms of Service. All prices are exclusive of applicable taxes. If the plan sponsor elects to hire an external investment advisor, the plan sponsor will pay such advisor as agreed between the plan sponsor and advisor. For more information, please see our pricing page.

The SMB 401(k) with the most payroll integrations2

Help take the burden off your HR team. We sync with 500+ payrolls to help streamline administrative tasks.

PLAN BENEFITS FOR EMPLOYERS

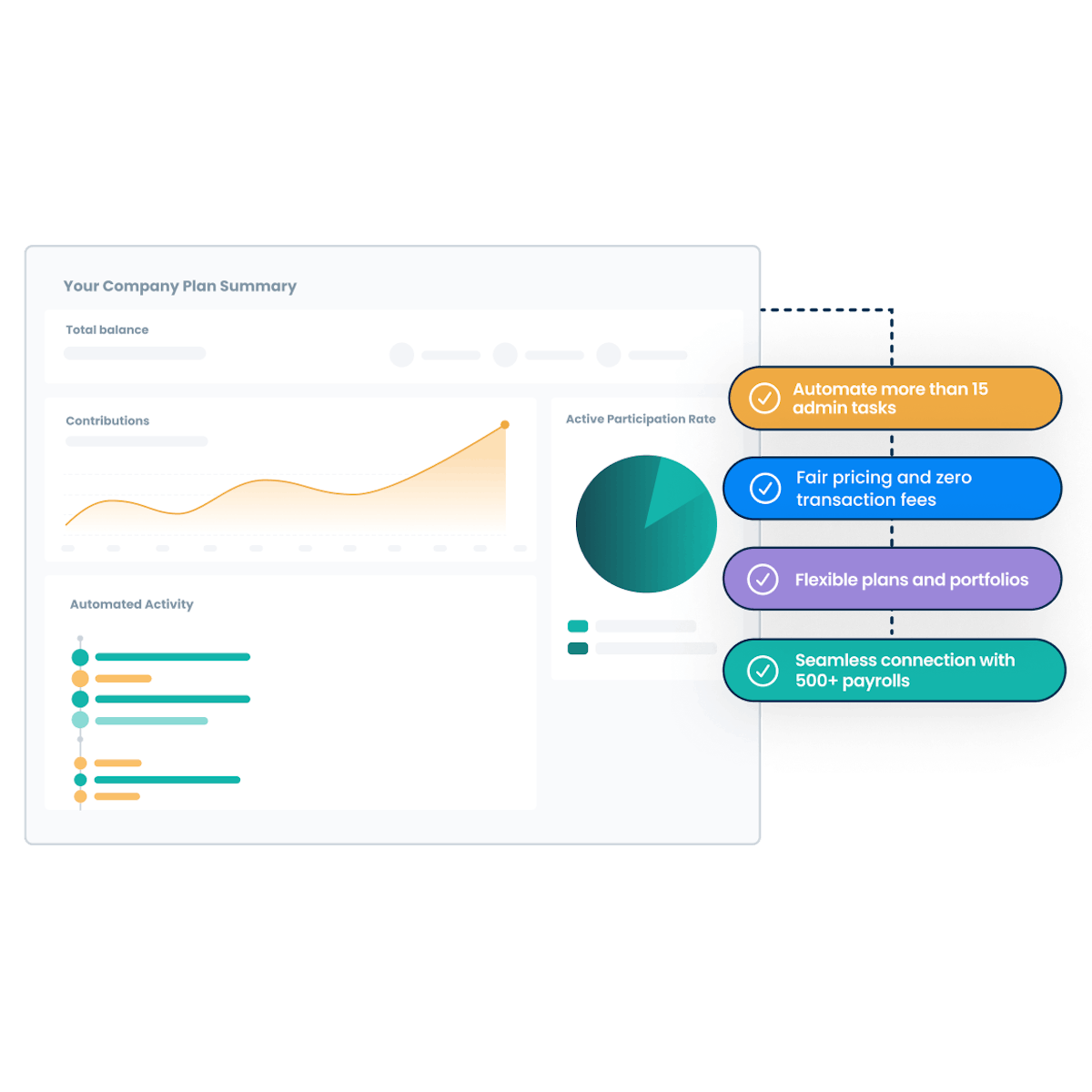

Focus on running your business. Not your 401(k) plan.

Recruit & retain top talent. A Human Interest study found that a retirement plan is the most-wanted benefit, after health insurance.3

Easy to start, easy to use. Admin dashboards provide insight into plan participation, reporting, and more.

Reduce manual work. In-house recordkeeping and compliance — plus select 3(16) fiduciary services depending on your service level.

Tax benefits. Offering a small business retirement plan, like a Human Interest 401(k), can offer many tax advantages to employers.

PLAN BENEFITS FOR EMPLOYEES

Give your employees the 401(k) they deserve.

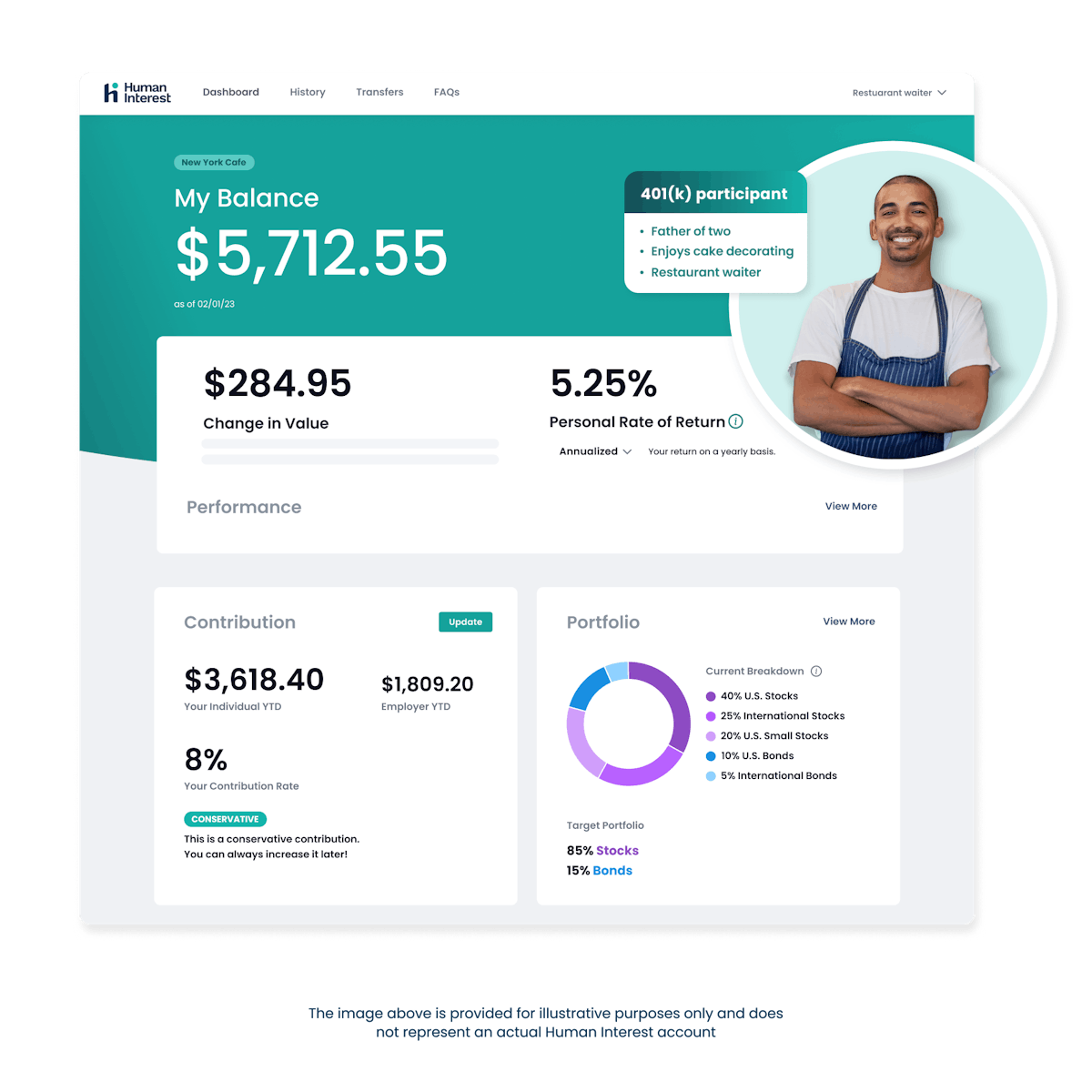

Easy onboarding. Your small business employees can sign up in minutes—no paperwork, no confusion.

Easy-to-navigate dashboard. Employees can quickly check balances and update preferences.

Built-in education. Enrollment webinars and online resources help employees get the most from plans.

Automated salary deferrals. Employees can choose to make contributions with each paycheck.

Clear, affordable 401(k) pricing

Customized retirement plans start at $120 per month + $5 per employee per month.

Get Started401(k) resources for small business owners

Are 401(k) plans required?

See if your state requires employers to offer a retirement savings plan.

Investment philosophy

Employees can access mutual funds in every major asset category.

Starting a 401(k) plan

Discover how small business owners can start and manage a 401(k) plan

When to offer a 401(k)

Learn the signs your small business is ready to offer retirement benefits to employees.

401(k) plan design

Get an overview of what plan design is and what the plan features employers must review.

401(k) plans for small business

frequently asked questions